Saturday, July 30, 2011

Adam Smith Would Neither Recognize Nor Approve Of Our Financial, Monetary, Economic Or Legal Systems

The father of modern economics - Adam Smith - is used as a poster child to support the status quo that we have today. Smith is invoked as the patron saint of free market economics.

In fact, Smith would neither recognize or approve of our current financial, monetary, economic or legal systems.

I noted last year:

Americans have traditionally believed that the "invisible hand of the market" means that capitalism will benefit us all without requiring any oversight. However, as the New York Times notes, the real Adam Smith did not believe in a magically benevolent market which operates for the benefit of all without any checks and balances:

Smith railed against monopolies and the political influence that accompanies economic power ...Smith worried about the encroachment of government on economic activity, but his concerns were directed at least as much toward parish councils, church wardens, big corporations, guilds and religious institutions as to the national government; these institutions were part and parcel of 18th-century government...

Smith was sometimes tolerant of government intervention, ''especially when the object is to reduce poverty.'' Smith passionately argued, ''When the regulation, therefore, is in support of the workman, it is always just and equitable; but it is sometimes otherwise when in favour of the masters.'' He saw a tacit conspiracy on the part of employers ''always and everywhere'' to keep wages as low as possible.

Paul Krugman pointed out:

Adam Smith ... may have been the father of free-market economics, but he argued that bank regulation was as necessary as fire codes on urban buildings, and called for a ban on high-risk, high-interest lending, the 18th-century version of subprime.

And Damon Vrabel wrote:

It seems ridiculous to point this out, but sovereign debt implies sovereignty. Right? Well, if countries are sovereign, then how could they be required to be in debt to private banking institutions? How could they be so easily attacked by the likes of George Soros, JP Morgan Chase, and Goldman Sachs? Why would they be subjugated to the whims of auctions and traders?

A true sovereign is in debt to nobody and is not traded in the public markets. For example, how would George Soros attack, say, the British royal family? [Vrabel is presumably referring to Soros' currency speculation against the British pound and other currencies.] It’s not possible. They are sovereign. Their stock isn’t traded on the NYSE. He can’t orchestrate a naked short sell strategy to destroy their credit and force them to restructure their assets. But he can do that to most of the other 6.7 billion people of the world by designing attack strategies against the companies they work for and the governments they depend on.

The fact is that most countries are not sovereign (the few that are are being attacked by [the big Western intelligence services] or the military). Instead they are administrative districts or customers of the global banking establishment whose power has grown steadily over time based on the math of the bond market, currently ruled by the US dollar, and the expansionary nature of fractional lending. Their cult of economists from places like Harvard, Chicago, and the London School have steadily eroded national sovereignty by forcing debt-based ... currencies on countries.

We long ago lost the free market envisioned by Adam Smith in the “Wealth of Nations” [the book widely considered to be the foundation of modern economic theory]. Such a world would require sovereign currencies.... Only then could there be a “wealth of nations.” But now we have nothing but the “debt of nations.” The exponential math of debt by definition meant that countries would only lose their wealth over time and become increasingly indebted to the global central banking network.

Smith also knew that trust was a basic ingredient of a sound economy. As I noted in March:

Because strong enforcement of laws against fraud is a basic prerequisite for trust, I believe Smith would be disgusted by the lack of prosecution of Wall Street fraudsters today.In 1998, Paul Zak (Professor of Economics and Department Chair, as well as the founding Director of the Center for Neuroeconomics Studies at Claremont Graduate University, Professor of Neurology at Loma Linda University Medical Center, and a senior researcher at UCLA) and Stephen Knack (a Lead Economist in the World Bank's Research Department and Public Sector Governance Department) wrote a paper called Trust and Growth, arguing:

Adam Smith ... observed notable differences across nations in the 'probity' and 'punctuality' of their populations. For example, the Dutch 'are the most faithful to their word.'John Stuart Mill wrote: 'There are countries in Europe . . . where the most serious impediment to conducting business concerns on a large scale, is the rarity of persons who are supposed fit to be trusted with the receipt and expenditure of large sums of money' (Mill, 1848, p. 132).

Enormous differences across countries in the propensity to trust others survive

today.

***

Trust is higher in 'fair' societies.

***

High trust societies produce more output than low trust societies. A fortiori, a sufficient amount of trust may be crucial to successful development. Douglass North (1990, p. 54) writes,The inability of societies to develop effective, lowcost enforcement of contracts is the most important source of both historical stagnation and contemporary underdevelopment in the Third World.***

If trust is too low in a society, savings will be insufficient to sustain

positive output growth. Such a poverty trap is more likely when institutions -

both formal and informal - which punish cheaters are weak.

And Smith warned against the pitfalls of fiat currencies unpegged to anything real:

The problem with fiat money is that it rewards the minority that can handle money, but fools the generation that has worked and saved money.It is certain that Smith would rail against our current financial, monetary, economic and legal systems as violating the most important foundations of sound economics.

Friday, July 29, 2011

"Moody's Places AAA Ratings Of 177 U.S. Public Finance Issuers On Review For Possible Downgrade Due To Review Of U.S. Government's AAA Rating"

Moody's announced today:

Moody's Investors Service has placed under review for possible downgrade the Aaa ratings of 177 public finance credits, affecting a combined $69 billion of outstanding debt. The credits include 162 local governments in 31 states, 14 housing finance programs and one university. A complete list of affected securities and additional analysis is available at www.moodys.com/USRatingActions.

These actions relate to Moody's July 13 decision to place the Aaa government bond rating of the United States under review for downgrade, and reflect the rating agency's assessment that some Aaa public finance ratings would likely be indirectly affected by potential credit deterioration of the sovereign.

***

In a previous action on July 19, Moody's placed the ratings of five Aaa U.S. state governments under review for possible downgrade, affecting approximately $24 billion of general obligation and related debt. Those states are Maryland, New Mexico, South Carolina and Tennessee and the Commonwealth of Virginia.

The entities on down grade watch include:

- The Colorado Housing and Finance Authority's Single Family Mortgage Bonds and the Single Family Program Bonds, 2009 Class I

- Idaho Housing and Finance Association's Single Family Mortgage Senior Bonds, Series 1996B, Series 1996C, Series 1998D, Series 1999F, Series 1999-I*, Series 2000A, Series 2000C, and Series 2000D

- Kentucky Housing Corporation's Housing Revenue Bonds

- Utah Housing Corporation's Single Family Mortgage Senior Bonds, Series 1998G, Series 2000A and NIBP

- The University of Washington

- The Smithsonian Institution

Top Reagan Advisors: Raise Taxes on the Wealthy

Preface: As I've previously noted, I think that there are arguments for doing away with all taxes. However, if we're going to have taxes, the top 1% should pay their fair share.

Of course, if we prosecuted fraud and clawed back ill-gotten gains we wouldn't be in such a deep hole.

Reagan's domestic policy advisor (Bruce Bartlett) said Wednesday that it was a myth that tax cuts are the key to prosperity, that higher taxes may actually help the economy, and reminded people that Reagan raised the capital gains rate:

(Reagan actually raised taxes 11 times).

Bartlett also recently pointed out:

Taxes were cut in 2001, 2002, 2003, 2004 and 2006.

It would have been one thing if the Bush tax cuts had at least bought the country a higher rate of economic growth, even temporarily. They did not. Real G.D.P. growth peaked at just 3.6 percent in 2004 before fading rapidly. Even before the crisis hit, real G.D.P. was growing less than 2 percent a year...

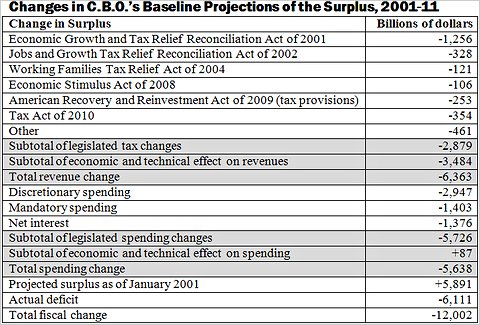

According to a recent C.B.O. report, they reduced revenue by at least $2.9 trillion below what it otherwise would have been between 2001 and 2011. Slower-than-expected growth reduced revenue by another $3.5 trillion.

Spending was $5.6 trillion higher than the C.B.O. anticipated for a total fiscal turnaround of $12 trillion. That is how a $6 trillion projected surplus turned into a cumulative deficit of $6 trillion.

Ronald Reagan's budget director David Stockman called the Bush tax cuts the "worst fiscal mistake in history", and said that extending them will not boost the economy.

And even Reagan's Assistant Secretary of Treasury with impeccable conservative credentials, who is widely credited with being the "father of supply-side economics" (Paul Craig Roberts) maintains that the Bush tax cuts made no economic sense ... even from a supply-side point of view.

As Roberts wrote in 2006:

The George W. Bush regime was faced with no stagflation and no worsening trade-offs between employment and inflation. The Bush administration did not use changes in the marginal rate of taxation to correct a mistaken policy mix or an oversight in economic policy. Moreover, global labor arbitrage is causing American jobs to be outsourced abroad. As Americans are experiencing declining opportunities to work, the response of labor supply to better incentives is small. Similarly, US companies are locating their investments in plant and equipment abroad. The substitution of foreign for American labor and the relocation abroad of US plant and equipment prevent reductions in marginal tax rates from having any appreciable effect on aggregate supply in the US.It's not just Bush. Roberts laments that the current debt ceiling shenanigans may be:

I am not a partisan of Dubya’s tax cuts. Income distribution is a legitimate issue. This is especially the case when offshore production and jobs outsourcing are destroying the American middle class.

Just as Dubya hides behind "freedom and democracy" to wage wars of naked aggression, he hides behind supply-side economics in order to reward his cronies.

A perfectly orchestrated scenario for getting rid of the New Deal and the Great Society that use up money that could be spent on wars and bailouts and tax cuts for the rich.Read this for background on why tax cuts for the richest and tax increases for the rest hurt the economy.

The World's Biggest Central Bank Has Private Shareholders

As I've pointed out for years, the Bank for International Settlements (BIS) is owned by the world's central banks, which are in turn owned by the big banks. See this and this.

It turns out there may be a very interesting wrinkle to the private ownership issue.

By way of background, BIS is often called the "central banks' central bank", as it coordinates transactions between central banks, and which is the entity determining the level of reserves banks are required to keep worldwide.

As Spiegel reported in 2009:

The BIS is a closed organization owned by the 55 central banks. The heads of these central banks travel to the Basel headquarters once every two months, and the General Meeting, the BIS's supreme executive body, takes place once a year.But as the New York Federal Reserve Bank currently states on its website:

As of March 2006, the BIS had 55 shareholding central banks from around the world. As of March 2006, the Bank’s assets were approximately $221 billion, including $5.8 billion of its own funds.So the private banks own the Fed (and most other central banks), and the central banks - and private shareholders - in turn own BIS, the global bank regulator.When the BIS initially raised capital, participating banks were given the option to buy BIS shares or arrange for those shares to be bought by the public. Currently, 86 percent of the shares of the BIS are registered in the names of central banks, and 14 percent are held by private shareholders. The shares owned by private shareholders consist of part of the French and Belgian issues and all of the shares that were in the original U.S. issue in 1930.

It would obviously be very interesting to find out who these private shareholders are.

And to find out if the shareholders enjoy any special benefits. As Spiegel notes:

Formally registered as a stock corporation, it is recognized as an international organization and, therefore, is not subject to any jurisdiction other than international law.Could that mean that the private shareholders owning 14% of the world's central bank have somehow been "grandfathered in", and are immune from taxes and other national rules? Wouldn't it be interesting to find out?It does not need to pay tax, and its members and employees enjoy extensive immunity. No other institution regulates the BIS, despite the fact that it manages about 4 percent of the world's total currency reserves, or €217 trillion ($304 trillion), as well as 120 tons of gold...

Central bankers are not elected by the people but are appointed by their governments. Nevertheless, they wield power that exceeds that of many political leaders. Their decisions affect entire economies, and a single word from their lips is capable of moving financial markets. They set interest rates, thereby determining the cost of borrowing and the speed of global financial currents.

The New York Fed claims that the private BIS shareholders don't have voting rights:

All shareholders receive theThis may or may not be true. It is common for powerful and wealthy people informally influence agency decisions. Just look at every captured financial regulator in the United States.Bank’s dividends. However, private shareholders do not have voting rights or representation at the BIS annual meetings. Only a country's central bank or its nominee may exercise the rights of representation and voting.

But whether or not the shareholders get special treatment or influence the decisions of the world's most powerful banking institution, it is still newsworthy that there are private parties with not insignificant ownership interests.

Update: Apparently, the information on the New York Fed's website is out of date. BIS' website says that the private shares were repurchases in 2003, so that now only central banks own shares.

Thursday, July 28, 2011

Giant Banks Lobby to Raise the Debt Ceiling and Slash Public Benefits ... So They Can Keep Sucking at the Public Teat

Economist Dean Banker notes:

Wall Street will suffer more than anyone from a default and it will not let it happen. The public should know this, certainly Wall Street does.

No wonder the fatcats running the giant banks which received tens of trillions in bailouts, loans and guarantees from the American public are screaming loudly that the debt ceiling must be raised.

Robert Reich points out:

Why has Standard & Poor's decided now's the time to crack down on the federal budget -- when it gave free passes to Wall Street's risky securities and George W. Bush's giant tax cuts for the wealthy, thereby contributing to the very crisis its now demanding be addressed?

Could it have anything to do with the fact that the Street pays Standard & Poor's bills?

Remember, the big 3 government-sponsored rating agencies routinely took bribes as their normal business model, committed massive fraud which greatly contributed to the financial crisis, covered up improper ratings after the fact, and otherwise sold their soul (in their own words). And see this and this.

Some complain about the poor sucking on the government teat.

But the fact that Wall Street controls the rating agencies, and the rating agencies are now creating an artificial emergency sounds like the powers-that-be - the giant banks which run this country - are trying to protect their government teat of perpetual bailouts from the public coffers.

And of course, they are the ones calling for slashing of spending which helps the public. Even though - as conservative writer Michael Rivero points out:

Social Security is not "unfunded" nor is it an "entitlement." That is YOUR money in that trust fund. You worked for it, and it was taken out of all your paychecks your entire working life.The debt crisis might be real ... I've been warning about it for years (and see this and this).

The Social Security Trust fund invested your money by loaning it to the US Government, which is the largest single holder of US Government debt. But the US Government is already in default in fact, as the actual tax revenues have not even come close to the projections on which the budgets were drawn up.

So the US Government has looked at all the entities they owe money to and decided that stiffing the American people is the least likely to cause them harm. They will pay the bankers and they will pay foreign nations and they will continue to bail out Wall Street for the mortgage-backed securities fraud by embezzling your retirement money you gave them in trust. The US Government is robbing you to save the private central bank! [i.e. the big banks. See this and this.]

The potential downgrade to America's credit is real ... I've been warning about that for years, as well.

But the way that the rating agencies and Wall Street are approaching the debt ceiling debate is a scam. See this, this and this.

After all, they aren't even discussing the spending cuts which must be enacted to reduce our debt:

(1) Ending the imperial wars, which reduce - rather than strengthen - national security (and see this and this);

(2) Ending the never-ending bailouts for Wall Street;

(3) Prosecuting fraud and clawing back the ill-gotten gains;

(4) Ending the Bush tax cuts, which are hurting the economy; and

(5) Slashing pensions for public employees, at least when they are pegged to an artificially "spiked" final year's salary.

Wednesday, July 27, 2011

Tax Cuts for the Middle Class and Poor STIMULATE The Economy, But Tax Cuts for the Wealthy HURT The Economy

Preface: There is an argument for repealing all taxes. I have a strong libertarian streak, and there are arguments that government is wasting our tax money on imperial wars which weaken our national security and other shenanigans. There are also various legal arguments alleging that income taxes are illegal. This essay solely asks how taxes - if we do have them, and given that tax and other government policy has radically redistributed wealth upwards, creating current below-third-world-levels of inequality (greater than seen for many years before the Great Depression) - effect the economy.

Extreme conservatives push for tax cuts ... but just for the wealthy.

Extreme liberals are against all tax cuts, believing that we need higher taxes to pay for government programs ... and that taxes somehow won't create any drag on the economy.

Both extremes are wrong.

In fact, tax cuts for the middle class and poor stimulate the economy, but tax cuts for the wealthy hurt the economy.

This is actually a very simple concept, although some politicians and economists unintentionally or intentionally muddy the waters.

As Ed Harrison notes today:

Bruce Bartlett, a Republican political appointee and domestic policy advisor to Ronald Reagan, points out that:

Taxes were cut in 2001, 2002, 2003, 2004 and 2006.

It would have been one thing if the Bush tax cuts had at least bought the country a higher rate of economic growth, even temporarily. They did not. Real G.D.P. growth peaked at just 3.6 percent in 2004 before fading rapidly. Even before the crisis hit, real G.D.P. was growing less than 2 percent a year...

According to a recent C.B.O. report, they reduced revenue by at least $2.9 trillion below what it otherwise would have been between 2001 and 2011. Slower-than-expected growth reduced revenue by another $3.5 trillion.

Spending was $5.6 trillion higher than the C.B.O. anticipated for a total fiscal turnaround of $12 trillion. That is how a $6 trillion projected surplus turned into a cumulative deficit of $6 trillion.

Bartlett offers this killer chart as a summary of the numbers:

If you recall, it was George W. Bush’s father, GWH Bush, who, when campaigning against Reagan, called supply side economics’ claims that tax cuts pay for themselves Voodoo Economics. And Bush was proved right when deficits spiralled out of control and both Reagan and Bush were forced to raise taxes.

***

The Bush tax cuts accrued disproportionately to the wealthy. The Tax Policy Center shows that 65 percent of the dollar value of the Bush tax cuts accrued to the top quintile, while 20 percent went to the top 0.1 percent of income earners.

If you want to talk about redistribution, there it is.

The New York Times reported in 2007:

Families earning more than $1 million a year saw their federal tax rates drop more sharply than any group in the country as a result of President Bush’s tax cuts, according to a new Congressional study.

The study, by the nonpartisan Congressional Budget Office, also shows that tax rates for middle-income earners edged up in 2004, the most recent year for which data was available, while rates for people at the very top continued to decline.

Based on an exhaustive analysis of tax records and census data, the study reinforced the sense that while Mr. Bush’s tax cuts reduced rates for people at every income level, they offered the biggest benefits by far to people at the very top — especially the top 1 percent of income earners.

The Economic Policy Institute reported in June:

The Bush-era tax changes conferred disproportionate benefits to those at the top of the earnings distribution, exacerbating a trend of widening income inequality at a time of already poor wage growth.

***

The top 1% of earners (making over $620,442) received 38% of the tax cuts. The lower 60% of filers (making less than $67,715) received less than 20% of the total benefit of Bush’s tax policies.

The Bush-era tax cuts were designed to reduce taxes for the wealthy, and the benefits of faster growth were then supposed to trickle down to the middle class. But the economic impact of cutting capital gains rates and lowering the top marginal tax rates never materialized for working families. Inflation-adjusted median weekly earnings fell by 2.3% during the 2002-07 economic expansion, which holds the distinction for being the worst economic expansion since World War II.

This isn't complicated. Rampant inequality largely caused the Great Depression and the current economic crisis (and see this). Cutting taxes on the middle and lower classes reduces inequality and stimulates the consumer economy. But cutting taxes for the wealthy reduces aggregate consumer demand.

As economics professor Robert Reich notes:

Tax cuts for the little guy gives them more "poker chips" to play with, boosting consumer spending and stimulating the economy.First, the rich spend a smaller proportion of their wealth than the less-affluent, and so when more and more wealth becomes concentrated in the hands of the wealth, there is less overall spending and less overall manufacturing to meet consumer needs.

Second, in both the Roaring 20s and 2000-2007 period, the middle class incurred a lot of debt to pay for the things they wanted, as their real wages were stagnating and they were getting a smaller and smaller piece of the pie. In other words, they had less and less wealth, and so they borrowed more and more to make up the difference. As Reich notes:

Between 1913 and 1928, the ratio of private credit to the total national economy nearly doubled. Total mortgage debt was almost three times higher in 1929 than in 1920. Eventually, in 1929, as in 2008, there were “no more poker chips to be loaned on credit,” in [former Fed chairman Mariner] Eccles' words. And “when their credit ran out, the game stopped.”

And third, since the wealthy accumulated more, they wanted to invest more, so a lot of money poured into speculative investments, leading to huge bubbles, which eventually burst. Reich points out:In the 1920s, richer Americans created stock and real estate bubbles that foreshadowed those of the late 1990s and 2000s. The Dow Jones Stock Index ballooned from 63.9 in mid-1921 to a peak of 381.2 eight years later, before it plunged. There was also frantic speculation in land. The Florida real estate boom lured thousands of investors into the Everglades, from where many never returned, at least financially.

As Reich noted last year:

Small businesses are responsible for almost all job growth in a typical recovery. So if small businesses are hurting, we're not going to see much job growth any time soon.On the other hand (despite oft-repeated mythology), tax cuts for the wealthiest tend to help the big businesses ... which don't create many jobs.

In fact, economics professor Steve Keen ran an economic computer model in 2009, and the model demonstrated that:

Giving the stimulus to the debtors is a more potent way of reducing the impact of a credit crunch [than giving money to the big banks and other creditors].And as discussed above, Reich notes that tax cuts for the wealthy just lead to speculative bubbles ... which hurt, rather than help the economy.

Indeed, Keen has demonstrated that "a sustainable level of bank profits appears to be about 1% of GDP" ... higher bank profits lead to a ponzi economy and a depression. And too much concentration of wealth increases financial speculation, and therefore makes the financial sector (and the big banks) grow too big and too profitable.

Government policy has accelerated the growing inequality. It has encouraged American companies to move their facilities, resources and paychecks abroad. And some of the biggest companies in America have a negative tax rate ... that is, not only do they pay no taxes, but they actually get tax refunds. Indeed, instead of making Wall Street pay its fair share, Congress covered up illegal tax breaks for the big banks.

For those who still claim that tax cuts for the rich help the economy, the proof is in the pudding. The rich have gotten richer than ever before, and yet we have Depression-level housing declines, unemployment and other economic problems.

No wonder Ronald Reagan's budget director David Stockman called the Bush tax cuts the "worst fiscal mistake in history", and said that extending them will not boost the economy.

Bill O'Reilly Is Right: It's Unfair To Call the Norwegian Mass Murderer a Christian ... And It's Also Unfair to Call Arab Terrorists Muslims

Glenn Greenwald points out the hypocrisy in coverage of the Norwegian terror attack:

When it was widely assumed, based on basically nothing, that Muslims had been responsible for this attack and that a radical Muslim group likely perpetrated it, it was widely declared to be a "terrorist" attack. That was the word that was continuously used. And yet, when it became apparent that Muslims were not involved and that, in reality, it was a right-wing nationalist with extremely anti-Muslim, strident anti-Muslim bigotry as part of his worldview, the word "terrorism" almost completely disappeared from establishment media discourse. Instead, he began to be referred to as a "madman" or an "extremist." And it really underscores, for me, the fact that this word "terrorism," that plays such a central role in our political discourse and our law, really has no objective meaning. It’s come to mean nothing more than Muslims who engage in violence, especially when they’re Muslims whom the West dislikes.

***

Every time there’s an act of violence undertaken by someone who’s Muslim, the commentary across the spectrum links his Muslim religion or political beliefs to the violence and tries to draw meaning from it, broader meaning. And yet, the minute that it turned out that the perpetrator wasn’t Muslim, but instead was this right-wing figure, the exact opposite view arose, which is, "Oh, his views and associations aren’t relevant. It’s not fair to attribute or to blame people who share his views or who inspired him with these acts." And it got depicted as being this sort of individual crazy person with no broader political meaning, and media interest disappeared. It’s exactly the opposite of how it’s treated when violence is undertaken by someone who’s Muslim.

But Christianity and Islam Are Different ...

Bill O'Reilly says:

No one believing in Jesus commits mass murder. The man might have called himself a Christian on the net, but he is certainly not of that faith.

Mr. O'Reilly is correct. Jesus taught love and "turning the other cheek".

He let outcasts and undesirables into his flock.

So the Norwegian terrorist is not truly a Christian. In fact, Mr. O'Reilly makes a very important point ... that you cannot judge someone by what they call themselves, but by their actions.

The same standard, of course, should apply to Muslims, Jews, and people of all faiths.

As I wrote last year:

If we ban mosques because some Muslims are murderers, we should also ban churches because Timothy McVeigh was a Christian.

Indeed, we should also ban synagogues because some Jews commit terrorism (see second bulleted paragraph).

Of course, anyone who sees their religion as the "good guys" and the other guy's religion as "evil" is living in a cartoon.

As Christian writer and psychiatrist M. Scott Peck explained, there are different stages of spiritual maturity. Fundamentalism - whether it be Muslim, Christian, Jewish or Hindu fundamentalism - is an immature stage of development.

[Remember that Adolph Hitler professed to be a Christian, and churches in Nazi Germany mainly supported Adolph Hitler's unjust fascist policies. And Christian, Jewish and Muslim governments all carry out terror against their own people ... and then try to blame it on the other guy.

There are peaceful, contemplative Muslim sects - think the poet Rumi the poet and Sufis - and violent sects, just as there are contemplative Christian orders and violent Christian sects. ]

Indeed, a Christian fundamentalist who kills others in the name of religion is much more similar to a Muslim fundamentalist who kills other in the name of his religion than to a Christian who peacefully fights for justice and truth, helps the poor, or serves to bring hope to the downtrodden.

***

The war on terror is largely a religious war. [Just today, a new report shows that the Air Force uses Christian and Old Testament teachings to justify the launch of nuclear weapons.]

As I pointed out in January:

ABC News is reporting that U.S. military weapons are inscribed with secret 'Jesus' Bible codes [the military subsequently endorsed this practice]Conservative Christians were the biggest backers of the Iraq war ...

One of the top Pentagon officials involved in the Iraq war - General William Boykin - literally:

Sees the "war on terror" as a religious war between Judeo-Christian civilization and Satan, with Islam of course cast in the latter role.Jeremy Scahill describes Boykin as:

A Deputy Undersecretary of Defense for Intelligence under Bush. Boykin was part of Donald Rumsfeld's inner circle at the Pentagon where he was placed in charge of hunting "high-value targets." Boykin was one of the key U.S. officials in establishing what critics alleged was death-squad-type activity in Iraq.Boykin's crusade is also important because one of his assigned jobs was:

Speeding up the flow of intelligence on terrorist leaders to combat teams in the field so that they can attack top-ranking terrorist leaders. It can easily be speculated that it is this urgency to obtain intelligence, and an uncompromising religious outlook backed by a [crusader] mentality, that has led to the lower echelons in the US military to adopt Saddam Hussein-like brutalities.Moreover, the U.S. military has just been busted trying to convert Afghanis to Christianity (the same thing happened in Iraq).

As Scahill notes:What's more, the center of this evangelical operation is at the huge US base at Bagram, one of the main sites used by the US military to torture and indefinitely detain prisoners.The bottom line is that - while torture was ordered by the highest level Bush administration officials in order to create a false link between 9/11 and Iraq - it seems like many of those who enthusiastically rallied around torture looked at it, literally, as a religious crusade.As I wrote on May 25th:

According to French President Chirac, Bush told him that the Iraq war was needed to bring on the apocalypse:

In Genesis and Ezekiel Gog and Magog are forces of the Apocalypse who are prophesied to come out of the north and destroy Israel unless stopped. The Book of Revelation took up the Old Testament prophesy:

"And when the thousand years are expired, Satan shall be loosed out of his prison, And shall go out to deceive the nations which are in the four quarters of the earth, Gog and Magog, to gather them together to battle and fire came down from God out of heaven, and devoured them."

Bush believed the time had now come for that battle, telling Chirac:

"This confrontation is willed by God, who wants to use this conflict to erase his people's enemies before a New Age begins"...

There can be little doubt now that President Bush's reason for launching the war in Iraq was, for him, fundamentally religious. He was driven by his belief that the attack on Saddam's Iraq was the fulfilment of a Biblical prophesy in which he had been chosen to serve as the instrument of the Lord.And British Prime Minister Tony Blair long-time mentor, advisor and confidante said:

Given that the Iraq war really was a crusade, the fact that the Pentagon is now saying that it may have to leave troops in Iraq for another decade shows that the crusade is still ongoing under Obama."Tony's Christian faith is part of him, down to his cotton socks. He believed strongly at the time, that intervention in Kosovo, Sierra Leone – Iraq too – was all part of the Christian battle; good should triumph over evil, making lives better."

Mr Burton, who was often described as Mr Blair's mentor, says that his religion gave him a "total belief in what's right and what's wrong", leading him to see the so-called War on Terror as "a moral cause"...

Anti-war campaigners criticised remarks Mr Blair made in 2006, suggesting that the decision to go to war in Iraq would ultimately be judged by God.

Indeed, churchgoers are more likely to back torture of suspected terrorists than atheists (and see this), and torture is apparently still continuing under the Obama administration.

As I noted last year, Arab terrorists are not actually motivated by religion at all:

University of Chicago professor Robert A. Pape - who specializes in international security affairs - points out:

Extensive research into the causes of suicide terrorism proves Islam isn't to blame -- the root of the problem is foreign military occupations.Wait, what? That can't be right!

But as Pape explains:Each month, there are more suicide terrorists trying to kill Americans and their allies in Afghanistan, Iraq, and other Muslim countries than in all the years before 2001 combined.But surely Pape and his team of University of Chicago researchers are wrong. Surely other security experts disagree, right?

***

New research provides strong evidence that suicide terrorism such as that of 9/11 is particularly sensitive to foreign military occupation, and not Islamic fundamentalism or any ideology independent of this crucial circumstance. Although this pattern began to emerge in the 1980s and 1990s, a wealth of new data presents a powerful picture.More than 95 percent of all suicide attacks are in response to foreign occupation, according to extensive research [co-authored by James K. Feldman - former professor of decision analysis and economics at the Air Force Institute of Technology and the School of Advanced Airpower Studies] that we conducted at the University of Chicago's Project on Security and Terrorism, where we examined every one of the over 2,200 suicide attacks across the world from 1980 to the present day. As the United States has occupied Afghanistan and Iraq, which have a combined population of about 60 million, total suicide attacks worldwide have risen dramatically -- from about 300 from 1980 to 2003, to 1,800 from 2004 to 2009. Further, over 90 percent of suicide attacks worldwide are now anti-American. The vast majority of suicide terrorists hail from the local region threatened by foreign troops, which is why 90 percent of suicide attackers in Afghanistan are Afghans.

Israelis have their own narrative about terrorism, which holds that Arab fanatics seek to destroy the Jewish state because of what it is, not what it does. But since Israel withdrew its army from Lebanon in May 2000, there has not been a single Lebanese suicide attack. Similarly, since Israel withdrew from Gaza and large parts of the West Bank, Palestinian suicide attacks are down over 90 percent.

Some have disputed the causal link between foreign occupation and suicide terrorism, pointing out that some occupations by foreign powers have not resulted in suicide bombings -- for example, critics often cite post-World War II Japan and Germany. Our research provides sufficient evidence to address these criticisms by outlining the two factors that determine the likelihood of suicide terrorism being employed against an occupying force.

The first factor is social distance between the occupier and occupied. The wider the social distance, the more the occupied community may fear losing its way of life. Although other differences may matter, research shows that resistance to occupations is especially likely to escalate to suicide terrorism when there is a difference between the predominant religion of the occupier and the predominant religion of the occupied.

Religious difference matters not because some religions are predisposed to suicide attacks. Indeed, there are religious differences even in purely secular suicide attack campaigns, such as the LTTE (Hindu) against the Sinhalese (Buddhists).

Rather, religious difference matters because it enables terrorist leaders to claim that the occupier is motivated by a religious agenda that can scare both secular and religious members of a local community -- this is why Osama bin Laden never misses an opportunity to describe U.S. occupiers as "crusaders" motivated by a Christian agenda to convert Muslims, steal their resources, and change the local population's way of life.

The second factor is prior rebellion. Suicide terrorism is typically a strategy of last resort, often used by weak actors when other, non-suicidal methods of resistance to occupation fail. This is why we see suicide attack campaigns so often evolve from ordinary terrorist or guerrilla campaigns, as in the cases of Israel and Palestine, the Kurdish rebellion in Turkey, or the LTTE in Sri Lanka.

One of the most important findings from our research is that empowering local groups can reduce suicide terrorism. In Iraq, the surge's success was not the result of increased U.S. military control of Anbar province, but the empowerment of Sunni tribes, commonly called the Anbar Awakening, which enabled Iraqis to provide for their own security. On the other hand, taking power away from local groups can escalate suicide terrorism. In Afghanistan, U.S. and Western forces began to exert more control over the country's Pashtun regions starting in early 2006, and suicide attacks dramatically escalated from this point on.

***

The first step is recognizing that occupations in the Muslim world don't make Americans any safer -- in fact, they are at the heart of the problem.

No.

The top security experts - conservative hawks and liberal doves alike - agree that waging war in the Middle East weakens national security and increases terrorism. See this, this, this, this, this and this.

As one of the top counter-terrorism experts (the former number 2 counter-terrorism expert at the State Department) told me, starting wars against states which do not pose an imminent threat to America's national security increases the threat of terrorism because:One of the principal causes of terrorism is injuries to people and families.(Take another look at the painting above).

And its not only war in general as an abstract concept. The methods we're using to wage war are increasing terrorism.

As one example, torture reduces our national security and creates new terrorists.

Unfortunately, we are continuing to indiscriminately kill civilians using drone strikes, and we are continuing to torture innocent people (see this, this, this, and this).

This is not a question of being a "Muslim-sympathizer". I am not a Muslim (personally, I and the rest of my family go to Church, albeit a non-dogmatic one). This isn't about religion at all.

Its all about being practical in protecting our national security.

Terrorists Aren't Muslims

Finally, Muslim scholars tell me that Islam prohibits the killing of innocent civilians. So terrorists are not true Muslims. Those claiming they are committing terrorist acts as Muslims are as credible as the Norwegian murderer or Timothy McVeigh trying to say they were following Christians values.

Indeed, the 9/11 hijackers used cocaine and drank alcohol, slept with prostitutes and attended strip clubs ... but they did not worship at any mosque. See this, this, this, this, this, this, this, and this.

These are hardly the acts of devout Muslims.

Tuesday, July 26, 2011

There's Only One Way to Avoid a Downgrade to U.S. Credit

According to Reuters, a majority of economists now think that U.S. credit will be downgraded.

The debt ceiling plans being proposed likely will not avoid a debt downgrade.

Indeed, as Zero Hedge notes, the cuts being proposed in the debt ceiling proposals would be offset by the costs of the downgrade:

The US downgrade alone, now virtually taken for granted by everyone, will offset any beneficial impact from any deficit reduction that will have to happen for the debt ceiling to be increased.

Indeed, many are starting to say that a downgrade is inevitable.

In truth and in fact, we could still avoid a downgrade ... but only if we immediately:

(1) End the imperial wars, which reduce - rather than strengthen - national security (and see this and this);

(2) End the never-ending bailouts for Wall Street;

(3) Prosecute fraud and claw back ill-gotten gains;

(4) End the Bush tax cuts, which Ronald Reagan's budget director David Stockman said were the worst fiscal mistake in history; and

(5) Slash pensions for public employees, at least when they are pegged to an artificially "spiked" final year's salary.

The talking heads will say that these actions are not politically feasible.

However, as I've previously noted, that phrase is just code for:

The powers-that-be don't want it, even if the people overwhelmingly and passionately support it.

Obama "Will Not Take Yes For An Answer" On Debt Ceiling Debate

Huffington Post notes:

House Speaker John Boehner says ... "Unfortunately, the president would not take yes for an answer," he said. "Even when we thought we might be close on an agreement, the president's demands changed."While it may be tempting for liberals to write this statement off as mere right-wing positioning, prominent liberal writers agree.

For example, Jeff Cohen writes:

Liberal groups are now mobilizing against the White House and reported deals that would cut Social Security, Medicare and Medicaid benefits. They accuse President Obama of being weak and willing to “cave” to corporate and conservative forces bent on cutting the social safety net while protecting the wealthy.Marshall Auerback argues:Those accusations are wrong.

The accusations imply that Obama is on our side. Or was on our side. And that the right wing is pushing him around.

But the evidence is clear that Obama is an often-willing servant of corporate interests -- not someone reluctantly doing their bidding, or serving their interests only because Republicans forced him to.

Since coming to Washington, Obama has allied himself with Wall Street Democrats who put corporate deregulation and greed ahead of the needs of most Americans:

- In 2006, a relatively new Senator Obama was the only senator to speak at the inaugural gathering of the Alexander Hamilton Project launched by Wall Street Democrats like Robert Rubin and Roger Altman, Bill Clinton’s treasury secretary and deputy secretary. Obama praised them as “innovative, thoughtful policymakers.” (It was Rubin’s crusade to deregulate Wall Street in the late ‘90s that led directly to the economic meltdown of 2008 and our current crisis.)

- In early 2007, way before he was a presidential frontrunner, candidate Obama was raising more money from Wall Street interests than all other candidates, including New York presidential candidates Hillary Clinton and Rudy Giuliani.

- In June 2008, as soon as Hillary ended her campaign, Obama went on CNBC, shunned the “populist” label and announced: “Look: I am a pro-growth, free-market guy. I love the market.” He packed his economic team with Wall Street friends -- choosing one of Bill Clinton’s Wall Street deregulators, Larry Summers, as his top economic advisor.

- A year into his presidency, in a bizarre but revealing interview with Business Week, Obama was asked about huge bonuses just received by two CEOs of Wall Street firms bailed out by taxpayers. He responded that he didn’t “begrudge” the $17 million bonus to J.P. Mogan’s CEO or the $9 million to Goldman Sachs’ CEO: “I know both those guys, they are very savvy businessmen,” said Obama. “I, like most of the American people, don’t begrudge people success or wealth. That is part of the free-market system.”

After any review of Obama’s corporatist ties and positions, the kneejerk response is: “Yes, but Obama was a community organizer!”

He WAS a community organizer. . .decades before he became president. Back when Nelson Mandela was in prison and the U.S. government declared him the leader of a “terrorist organization” while our government funded and armed Bin Laden and his allies to fight the Soviets in Afghanistan. That’s a long time ago.

It’s worth remembering that decades before Reagan became president, the great communicator was a leftwing Democrat and advocate for the working class and big federal social programs.

The sad truth, as shown by Glenn Greenwald, is that Obama had arrived at the White House looking to make cuts in benefits to the elderly. Two weeks before his inauguration, Obama echoed conservative scares about Social Security and Medicare by talking of “red ink as far as the eye can see.” He opened his doors to Social Security/Medicare cutters -- first trying to get Republican Senator Judd Gregg (“a leading voice for reining in entitlement spending,” wrote Politico) into his cabinet, and later appointing entitlement-foe Alan Simpson to co-chair his “Deficit Commission.” Obama’s top economic advisor, Larry Summers, came to the White House publicly telling Time magazine of needed Social Security cuts.

Glenn Greenwald writes:The debt ceiling dispute is not forcing a compromise on this President, but is instead is viewed by him as a golden opportunity to do what he’s always wanted to do.

***

Unlike President Hoover, who inherited the foundations of a huge credit bubble from the 1920s and found himself overwhelmed by it, this President is worse.

***

The predictable result is of his current stance is that, even as he claims to recognize the interlocking nature of the problems facing us and vows to “solve the problem” once and for all via a “grand bargain”, Obama is in fact tearing apart most of the foundations which were tentatively initiated under Hoover, but which came to full fruition under FDR. If he continues down this ruinous path, $150 billion/month in spending will be cut. Such economic thinking isn’t worthy of Mellon, let alone Herbert Hoover.

Obama ... has done more to subvert and weaken the left's political agenda than a GOP president could have dreamed of achieving. So potent, so overarching, are tribal loyalties in American politics that partisans will support, or at least tolerate, any and all policies their party's leader endorses – even if those policies are ones they long claimed to loathe.Progressive economist Michael Hudson writes:This dynamic has repeatedly emerged in numerous contexts. Obama has continued Bush/Cheney terrorism policies – once viciously denounced by Democrats – of indefinite detention, renditions, secret prisons by proxy, and sweeping secrecy doctrines.

He has gone further than his predecessor by waging an unprecedented war on whistleblowers, seizing the power to assassinate U.S. citizens without due process far from any battlefield, massively escalating drone attacks in multiple nations, and asserting the authority to unilaterally prosecute a war (in Libya) even in defiance of a Congressional vote against authorising the war.

And now he is devoting all of his presidential power to cutting the entitlement programmes that have been the defining hallmark of the Democratic party since Franklin Roosevelt's New Deal. The silence from progressive partisans is defeaning – and depressing, though sadly predictable.

***

Obama is now on the verge of injecting what until recently was the politically toxic and unattainable dream of Wall Street and the American right – attacks on the nation's social safety net – into the heart and soul of the Democratic party's platform. Those progressives who are guided more by party loyalty than actual belief will seamlessly transform from virulent opponents of such cuts into their primary defenders.

The most reasonable explanation for [Obama's] empty threat is that he is trying to panic the elderly into hoping that somehow the budget deal he seems to have up his sleeve can save them. The reality, of course, is that they are being led to economic slaughter. (And not a word of correction reminding the President of financial reality from Rubinomics Treasury Secretary Geithner, neoliberal Fed Chairman Bernanke or anyone else in the Wall Street Democrat administration, formerly known as the Democratic Leadership Council.)Hudson also states:It is a con. Mr. Obama has come to bury Social Security, Medicare and Medicaid, not to save them. This was clear from the outset of his administration when he appointed his Deficit Reduction Commission, headed by avowed enemies of Social Security Republican Senator Alan Simpson of Wyoming, and President Clinton’s Rubinomics chief of staff Erskine Bowles. Mr. Obama’s more recent choice of Republicans and Blue Dog Democrats be delegated by Congress to rewrite the tax code on a bipartisan manner – so that it cannot be challenged – is a ploy to pass a tax “reform” that democratically elected representatives never could be expected to do.

The devil is always in the details. And Wall Street lobbyists always have such details tucked away in their briefcases to put in the hands of their favored congressmen and dedicated senators. And in this case they have the President, who has taken their advice as to whom to appoint as his cabinet to act as factotums to capture the government on their behalf and create “socialism for the rich.”

***Usually a crisis is needed to create a vacuum into which these toxic details are fed. Wall Street does not like real crises, of course – except to make quick computer-driven speculative gains on the usual fibrillation of today’s zigzagging markets. But when it comes to serious money, the illusion of a crisis is preferred, staged melodramatically to wring the greatest degree of emotion out of the audience much like a good film editor edits a montage sequence. Will the speeding train run over the girl strapped to the tracks? Will she escape in time?

The train is debt; the girl is supposed to be the American economy. But she turns out to be Wall Street in disguise. The exercise turns out to be a not-so-divine comedy. Mr. Obama offers a plan that looks very Republican. But the Republicans say no. There is an illusion of a real fight.

***

Just as the City of London backed Britain’s Labour Party in taking over when the Conservative Party could not take such radical steps as privatizing the railroads and London tube system, and just as Iceland’s Social Democrats sought to plunge the economy into debt peonage to Britain and Holland, and the Greek Socialist Party is leading the fight for privatization and bank bailouts, so in the United States the Democratic Party is to deliver its constituency – urban labor, especially the racial minorities and the poor who are most injured by Pres. Obama’s austerity plan – to Wall Street. So Mr. Obama is doing what any good demagogue does: delivering his constituency to his campaign contributors on Wall Street.

HUDSON: I think it’s evil working with evil.... If you have to choose between paying Social Security and Wall Street, pay our clients, Wall Street.

***

What’s inefficient? Paying for people on Medicaid. Got to cut it. What’s inefficient? Medicare. Got to cut it. What’s inefficient? Paying Social Security. What is efficient? Giving $13 trillion to Wall Street for a bailout. Now, how on earth can the administration say, in the last three years we have given $13 trillion to Wall Street, but then, in between 2040 and 2075, we may lose $1 trillion, no money for the people?

***

It’s not about the debt ceiling. It’s about making an agreement now under an emergency conditions. You remember what Obama’s staff aide Rahm Emanuel said. He said a crisis is too important to waste. They’re using this crisis as a chance to ram through a financial policy, an anti-Medicare, anti-Medicaid, anti—selling out Social Security that they could never do under the normal course of things.***

They’re not going to cut back the war in Libya.

***

They’re going to have to decide what to cut back. So they’re going to cut back the bone and they’re going to keep the fat, basically. They’re going to say–they’re going to try to panic the population into acquiescing in a Democratic Party sellout by cutting back payments to the people–Social Security, Medicare–while making sure that they pay the Pentagon, they pay the foreign aid, they pay Wall Street.

[Interviewer]: Yeah. But what–I hear you. But what I’m–I’m saying, what could be an alternative policy? For example, don’t raise the debt ceiling. Number two, raise taxes on the wealthy. Number three, cut back military spending. I mean, there are ways to do this without having to borrow more money, aren’t there?

HUDSON: Of course.

***

Of course they could cut back the fat. Of course what they should do is change the tax system. Of course they should get rid of the Bush tax cuts. And the one good thing in President Obama’s speech two days ago was he used the term spending on tax cuts. So that’s not the same thing as raising taxes. He said just cut spending by cutting spending on tax cuts for the financial sector, for the speculators who count all of their income that they get, billions of income, as capital gains, taxed at 15 percent instead of normal income at 35 percent. Let’s get rid of the tax loopholes that favor Wall Street.

***

Mr. Obama has always known who has been contributing primarily to his political campaigns. We know where his loyalties lie now. And, basically, he promised change because that’s what people would vote for, and he delivered the change constituency to the campaign contributors...

And see this interview with progressive expert and writer Yves Smith:

Indeed, it is obvious to both liberals and conservatives that the entire debt ceiling debate is a circus intended to create a big enough "crisis" to justify redistributing wealth upwards ... again. See this, this and this.

Both Reid and Boehner's Debt Ceiling Plans Would Still Likely Result In a Credit Downgrade for the United States

The fight between Harry Reid and John Boehner's dueling debt plans is high melodrama.

But the fact is that both plans would likely result in a credit downgrade for the U.S.

Huffington Post notes:

CNN's Erin Burnett relayed word from her sources on Wall Street that the newest Republican plan would not satisfy the credit rating agencies, which have soured on the idea of a short-term solution to the debt ceiling debate....

"I think it is important to emphasize that most people think both of the plans are really Band-Aids and don't deal in any significant way with the spending and cost issues in the country," Burnett said. "The issue was that Speaker Boehner's plan does not cut enough spending right away. Harry Reid's plan would cut about $2.7 trillion. Just because it is bigger than Speaker Boehner's plan is really the reason the Boehner plan may still trigger a downgrade."

Burnett was far from equivocal. At one point she added that, per a conversation with an investor, "in the short material, either deal will probably be enough." But then she went back to waxing skeptically at the Boehner approach.

"Really interesting this afternoon, when I was talking to an investor who had met with the ratings agencies at Standard & Poor, talking about the potential of a downgrade -- which by the way could raise interest rates the same way a potential default could -- and they said the Boehner plan probably wouldn't hit the hurdle to prevent a downgrade," she added. "Even if that deal was reached, you could still get a downgrade. It is unclear whether that would happen for sure, but that would be a real possibility. Whereas the Reid plan, even though a lot of the parts of that are seen by many as gimmicks, probably would pass that hurdle and you wouldn't get that immediate downgrade. That's an interesting distinction."

In actuality, the distinction is rather bland. The crux of the difference between the Reid and Boehner approaches is that one would last through the 2012 election by counting the so-called peace-dividend while the other one would require another vote as well as a (likely-to-fail) vote on the balanced budget amendment. Beyond that, they are fairly similar -- each using the cuts agreed to during talks organized by Vice President Joseph Biden, each setting up a powerful congressional committee to find additional deficit-reduction measures.

Paul Craig Roberts - a true conservative, who was a Wall Street Journal editor and Assistant Secretary of the Treasury under Reagan - slams the Republican intransigence on the debt.

But the Democratic plan is no better.

As Fox News reports:

Senate Democrats' inclusion in their proposed debt package of $1 trillion in savings from the wars in Iraq and Afghanistan may not satisfy ratings agencies threatening a credit downgrade since the wars were expected to end with or without a debt deal.As Anti War points out:

***

A new memo from Goldman Sachs also suggests Congress could end up imperiling the U.S. credit rating by counting war savings.

The memo, provided to Fox News by a GOP aide, said that if the Senate plan and its supposed war savings passes without a follow-up process, "a ratings downgrade could ensue."

***

Nearly half of the deficit reduction in Reid's plan would come from phantom war savings, according to the Goldman memo.

"The (withdrawal of troops from Iraq and Afghanistan) would show up in official budget estimates as savings of about $1.2 trillion versus current law," the memo reads. "If this proposal were to prevail without a credible follow-on process, a ratings downgrade could ensue, since against most outside baseline budget estimates only the first portion of spending cuts, and not the war spending savings, would show up as deficit reduction."

The first portion was estimated to be worth just $1.5 trillion.

"That would leave the fiscal consolidation far short of the ~$4 trillion S&P has said it is looking for, with no catalyst for additional deficit reduction before 2013," Goldman warned.

Senate Democrats have issued a new “savings” plan that would nominally pare the projected deficit by over $1 trillion simply by assuming that the costs of the wars in Iraq and Afghanistan will eventually go away by virtue of those wars ending.

This has spawned a myriad of criticism, including a leaked Goldman Sachs memo warning that the nation faces a credit downgrade if it tries to use this sort of on-paper gimmick instead of actual cuts in spending.

And indeed, while politicians may be comfortable with the notion that the wars will end at some point in the next decade, it isn’t clear at all that this will be the case. Officials are already talking up continuing in Afghanistan long beyond 2014, while the war in Iraq seems set to be extended for “years to come.”

The memo noted that this war savings was only a problem “without a credible follow-on process,” which is to say an actual effort to end those wars. Given strong Democratic opposition to other efforts to end wars (including the ongoing war in Libya), it seems hard to believe officials are looking at doing anything credible about the seemingly endless conflicts.

In other words, the Democrats don't actually want to end the wars ... but want to get credit for reducing the debt by pretending that they are going to end them.

As I've noted for years our government leaders won't even talk about slashing the military-industrial complex, which is ruining our economy with unnecessary imperial adventures?

America is losing its strength because it is trying to act like an empire ... even when it has run out of money to do so. See this, this and this.

Federal Reserve Attorneys: Fed Banks Are "Not Agencies" But "Independent Corporations" With "Private Boards of Directors"

I noted yesterday that the Federal Reserve has admitted that its 12 member banks are private - not governmental - entities.

Reader Siesta00000 sent me the following post with links to C-Span video of two of the Federal Reserve's senior counsel stating in court that this is true [I've edited for readability]:

During the second circuit court of appeals case for FOX News & Bloomberg v. Board of Governors lawyers in defense of the Fed make some revealing statements during the arguments. At about 13:45, the Fed lawyer stated:As a reader notes:"We do not believe the Federal Reserve Board is an agency, the Board of Governors, . . . the Federal Reserve Bank excuse me." (He made the mistake of saying the Federal Reserve Board when he meant the Federal Reserve Bank.)

***

He admitted the Federal Reserve Banks were not Federal Agencies in a court of law. Watch the lawyer's statement: here [video will play automatically once you click, but may take awhile to load. The videos are pre-set to play the relevant section, so you need not keep track of the times noted below.]

Another Federal Reserve lawyer goes further at 44:22 to state:[The Federal Reserve Banks are] independent corporations [which carry on the day-to-day operations. But emergency lending must be approved by the Federal Reserve's Board of Governors.]Watch the lawyer's statement: here.

At 46:23, the lawyer ... stated:[The Federal Reserve Banks are] not agencies [and they have] private board of directors.The most [interesting] evidence is in this clip: here.

They want to be, or rather want to 'seem to be', government entities in the public eye when it suits them, but then they claim in court they're in fact privately owned and don't have to follow the same rules as governmental institutions (i.e audits) when the government tries to intervene or regulate.

A very intelligently set-up organisation, blame government when it suits them, then hide from government when they need to be audited.

So It Begins ... Chicago Mercantile Exchange Slashes Value of Treasury Bills, Citing Volatility

As I've repeatedly noted, U.S. credit could well be downgraded even if a debt ceiling deal is reached. See this, this, this and this.

As Zeke Miller and Yves Smith note, the Chicago Mercantile Exchange has announced that it will give less credit for U.S. treasury bills and foreign sovereign debt posted as collateral.

This could be the first tangible effect of weakening U.S. credit.

Note: Technically, the CME downgraded treasury bills based upon concerns about volatility, not their inherent worth.

Monday, July 25, 2011

"Official CPI Is Running 3.6%, But If It Were Still Calculated The Way It Was Before The Greenspan Commission Went To Work, It Would Be 11.1%"

Addison Wiggin notes:

Whatever agreement emerges from the backroom dealing [on the debt], it is now almost sure to include what we’ve labeled a “stealth default” on Social Security.See this and this, and this for background.The White House quietly put out the word two weeks ago that it’s on board. Congressional Republicans think it’s a super idea, too. “There hasn’t been any economist anywhere that says we shouldn’t do that,” says Sen. Tom Coburn (R-Okla.).

Of course, they don’t call it a stealth default. They call it “chained CPI.”

This stealth default has occurred before. When Social Security was in trouble in 1983, one of the Greenspan Commission’s fixes included an adjustment to the consumer price index known as “substitution.”http://www.blogger.com/img/blank.gif

It works like this: If steak gets too expensive and you start buying hamburger instead… well, your price of beef hasn’t really gone up and your cost of living is unchanged. This is one of the reasons official CPI is running 3.6%, but if it were still calculated the way it was before the Greenspan Commission went to work, it would be 11.1%.Because Social Security benefits are keyed to CPI, this has resulted in a substantial savings for Uncle Sam. But fast-forward 28 years and Uncle Sam has burned through all the trust fund money just to pay his bills, and “substitution” alone isn’t good enough. Hence, “chained CPI.”

Under “chained CPI,” if your hamburger gets too expensive and you start buying beans instead… well, your price of protein hasn’t really gone up and your cost of living is unchanged.