Thursday, October 23, 2008

Gold May Do Well During the Later Stages of Deflation

Most people agree that gold does well during periods of inflation.

But what about during periods of deflation?

Leading economist Dr. Marc Faber wrote in October 2007 that gold will do well even in a deflation:

How would gold perform in a deflationary global recession? Initially gold could come under some pressure as well but once the realization sinks in how messy deflation would be for over-indebted countries and households, its price would likely soar.

Therefore, under both scenarios - stagflation or deflationary recession - gold, gold equities and other precious metals should continue to perform better than financial assets.

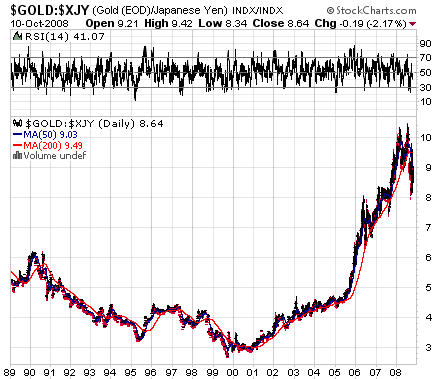

Faber's argument is supported by the following charts showing gold's performance as compared to the yen during Japan's "lost decade" of deflation:

Japan's deflation didn't definitively end until 2007 or 2008.

Japan's deflation didn't definitively end until 2007 or 2008.

This provides some evidence that gold may tend to hold or increase its value at least in the later part of the deflationary period as compared with the relevant national currency.

Moreover, about half the time, gold has risen during recessions in the United States:

(The grey vertical bars show periods of recession; if your browser is cutting off the right edge of the chart, click here for full image; the chart gives gold prices in monthly averages).

Close examination shows that gold often falls during the beginning stages of a recession, then rises in the later stages of the recession.

Remember that gold is supposed to be a save haven investment during times of uncertainty and instability. Plain vanilla recessions are not really times of uncertainty or instability, so the tendency of gold to rise in deflations should hold more true than during recessions.

See also this.

Note 1: If you want to see my forecast as to future deflation and inflation trends, read this.

Note 2: Conventional wisdom is that gold goes down in a deflation.

Note 3: On the other hand, some people argue that gold did well during the Great Depression, proving that it will do well in all future deflations. However, the Great Depression is not an accurate test for how gold performs during a deflation because (1) the U.S. was on the gold standard then; and (2) the government arbitrarily set the price for gold as part of the gold confiscation program, so the price of gold was not a free market price. Ignore any analysis of how gold performed during the Great Depression that doesn't take these factors into account.

Note 4: It is possible that factors external to Japan drove up the price of gold against yen during Japan's lost years. Further analysis is needed.

Note 5: I am not an investment advisor and this should not be taken as investment advice.

2 comments:

→ Thank you for contributing to the conversation by commenting. We try to read all of the comments (but don't always have the time).

→ If you write a long comment, please use paragraph breaks. Otherwise, no one will read it. Many people still won't read it, so shorter is usually better (but it's your choice).

→ The following types of comments will be deleted if we happen to see them:

-- Comments that criticize any class of people as a whole, especially when based on an attribute they don't have control over

-- Comments that explicitly call for violence

→ Because we do not read all of the comments, I am not responsible for any unlawful or distasteful comments.

CHECK THIS SLAVES!

ReplyDeleteSeems a well researched piece

This is a wonderful post. The things given are unanimous and needs to be appreciated by everyone.

ReplyDelete--------

dwilson1707

Scrap Gold Prices