As Absolute Return Partners wrote in its July newsletter:

The most important investment decision you will have to make this year and possibly for years to come is whether to structure your portfolio for deflation or inflation.

So which is it, inflation or deflation?

This is obviously a hot topic of debate, and experts weigh in on both sides. I’ve analyzed this issue in numerous previous posts (and try to make argue the case for inflation here), and every day there are new arguments one way or the other from some very smart people.

But deflation seems to be winning.

Who Says?

Nobel prize winning economist Joseph Stiglitz says:

Deflation is definitely a threat right now.

Alan Greenspan said on September 30th:

We are still, by any measure, in a disinflationary environment.

And the President of the Chicago Federal Reserve Bank, Charles Evans, said on September 9th:

Disinflationary winds are blowing with gale-force effect.

How Bad Could It Get?

The biggest deflation bears are rather pessimistic:

- Former chief Merrill Lynch economist David Rosenberg says that deflationary periods can last years before inflation kicks in

- Renowned economist Dr. Lacy Hunt says that we may have 15-20 years of deflation

- PhD economist Steve Keen says that – unless we reduce our debt – we could have a “never-ending depression”

These are the most pessimistic views I have run across. Most deflationists think that a deflationary period would last for a shorter period of time.

The Best Recent Arguments for Deflation

Following are some of the best arguments for deflation.

Unemployment

Wall Street Journal’s Scott Patterson writes that we won’t get inflation until unemployment is down below 5%:

A rule of thumb is that inflation doesn’t become sticky until the unemployment rate dips below 5%…

“I see very little prospect of accelerating inflation” partly because of the employment outlook, said Mark Zandi, chief economist of Moody’s Economy.com. “I don’t think the risk shifts toward inflation until 2011, or even 2012.”

It could take a lot longer for unemployment to go back down to 5% (and for consumers to have more money to spend again).

Job losses are accelerating.

JPMorgan Chase’s Chief Economist Bruce Kasman told Bloomberg:

[We've had a] permanent destruction of hundreds of thousands of jobs in industries from housing to finance.

A new report from Advance Realty and Rutgers - America’s New Post-Recession Employment Arithmetic - argues that we will not have a full recovery in unemployment until until 2017, and that:

• The Great 2007–2009 recession is the worst employment setback in the United States since the Great Depression.

• In the twenty months from December 2007 (the start of the recession) to August 2009 (the last month of available data as of this analysis), the nation lost more than 7.0 million private-sector jobs.

• The recession followed a very much-below-normal economic expansion (November 2001–December 2007) that was characterized by relatively weak private-sector employment growth of approximately 1 million jobs per year.

• This was less than one-half of the job-growth gains of the two preceding expansions (1982–1990 and 1991–2001), when average annual private-sector employment grew by 2.4 million jobs per year and 2.2 million jobs per year, respectively.

• In the preceding two expansions combined, private-sector employment growth per year was approximately 435,000 jobs higher than the annual growth in the number of people in the labor force.employment deficit.

• The weak economic expansion sandwiched between two recessions (2001, and 2007–2009) produced a lost employment decade.

• As of August 2009, the nation had 1.3 million (1,256,000) fewer private- sector jobs than in December 1999. This is the first time since the Great Depression of the 1930s that America will have an absolute loss of jobs over the course of a decade.

• From 1980-2000, the US gained a 35.5 million private-sector jobs. During the current decade, America has lost more than 1.7 million private-sector jobs.

• Total “employment deficit” could approach 9.4 million private-sector jobs by December 2009.

New jobs aren't being created.

Even Larry Summers says unemployment will remain 'unacceptably high' for years.

The New York Times points out that U.S. job seekers exceed openings by record ratio.

2 out of 5 Californians out of work.

Almost half of 16-24 year olds are unemployed.

(Note: hyperinflation is obviously an entirely different animal. For example, there was rampant unemployment in the Weimar Republic during its bout with hyperinflation ).

Debt Overhang and Deleveraging

Steve Keen argues that the government’s attempts to increase lending won’t work, consumers will keep on deleveraging from their debt, and that – unless debt is slashed – the massive debt overhang will keep us in a deflationary environment for a long time.

Edward Harrison notes:

Nomura’s Chief Economist Richard Koo wrote a book last year called "The Holy Grail of Macroeconomics" which introduced the concept of a balance sheet recession, which explains economic behaviour in the United States during the Great Depression and Japan during its Lost Decade. He explains the factor connecting those two episodes was a consistent desire of economic agents (in this case, businesses) to reduce debt even in the face of massive monetary accommodation.

When debt levels are enormous, as they are right now in the United States, an economic downturn becomes existential for a great many forcing people to reduce debt. Recession lowers asset prices (think houses and shares) while the debt used to buy those assets remains. Because the debt levels are so high, suddenly everyone is over-indebted. Many are technically insolvent, their assets now worth less than their debts. And the three D’s come into play: a downturn leads to debt deflation, deleveraging, and ultimately depression. The D-Process is what truly separates depression from recession ...

See a presentation by Koo here.

Leading investment advisor Ray Dalio says the same thing.

So does Albert Edwards, who argues that - even as the government tries to inflate its way out of all its problems and printing trillion in new treasuries - it is unable to catch up with the non-governmental balance sheet collapse:

The US Federal Reserve recently published their comprehensive flow of funds data for the US. This showed that the household sector continued to pay down debt for the fourth consecutive quarter. Corporates also started to pay down debt sharply in Q2 at a similar $200bn pace. The non-financial private sector paid down debt at a $435bn pace in Q2. This compares to a $2,116bn pace of expansion in 2007 (see chart below). Add to that the financial sector unwind and the total private sector is unwinding debt faster than the government is able to pile it up (hence the red line is still negative)! The lesson from the balance sheet recession in Japan is that the massive private sector headwind to growth has a long, long way to run.

If that is the case, we can expect, just like Japan, frequent relapses back into recession. The market now understands how an end of inventory de-stocking can boost GDP, i.e. it is the change in the change that matters. Similarly as Dylan Grice points out - link, it is the change in the fiscal deficit that is a net stimulus or drag to GDP. A massive 6pp stimulus last year is likely to turn into a 2pp drag on growth next year (see chart below). With continued private sector de-leveraging likely next year and beyond, how can one seriously not expect the global economy to relapse back into recession next year taking nominal GDP deep into an abyss?

Mish writes:

An over-leveraged economy is one prone to deflation and stagnant growth. This is evident in the path the Japanese took after their stock and real estate bubbles began to implode in 1989.

Leverage is increasing again, according to an article in Bloomberg:

Banks are increasing lending to buyers of high-yield company loans and mortgage bonds at what may be the fastest pace since the credit-market debacle began in 2007…

“I am surprised by how quickly the market has become receptive to leverage again,” said Bob Franz, the co-head of syndicated loans in New York at Credit Suisse…

Indeed, as I have repeatedly pointed out, Bernanke, Geithner, Summers and the chorus of mainstream economists have all acted as enablers for increasing leverage.

Mish continues:

Creative destruction in conjunction with global wage arbitrage, changing demographics, downsizing boomers fearing retirement, changing social attitudes towards debt in every economic age group, and massive debt leverage is an extremely powerful set of forces.

Bear in mind, that set of forces will not play out over days, weeks, or months. A Schumpeterian Depression will take years, perhaps even decades to play out.

Thus, deflation is an ongoing process, not a point in time event that can be staved off by massive interventions and Orwellian Proclamations “We Saved The World”.

Bernanke and the Fed do not understand these concepts, nor does anyone else chanting that pending hyperinflation or massive inflation is coming right around the corner, nor do those who think new stock market is off to new highs. In other words, almost everyone is oblivious to the true state of affairs.

Flattening Yield Curve Points Toward Deflation

PIMCO's Bill Gross said:

There has been significant flattening on the long end of the curve,” Gross said in an interview from Newport Beach, California, with Bloomberg Radio. “This reflects the re- emergence of deflationary fears. The U.S. is at the center of de-levering as opposed to accelerating growth.

David Rosenberg, Tyler Durden and Mish also believe that a flattening yield curve indicates deflation.

Bloomberg notes:

The difference in yield between nominal and inflation-protected Treasury securities maturing in one year is negative 0.4 percent, suggesting investors expect deflation during the next 12 months.

Pension Crisis

Pension expert Leo Kolivakis writes:

The global pension crisis is highly deflationary and yet very few commentators are discussing this.

Collapse of the Shadow Banking System

Hoisington’s Second Quarter 2009 Outlook states:

One of the more common beliefs about the operation of the U.S. economy is that a massive increase in the Fed’s balance sheet will automatically lead to a quick and substantial rise in inflation. [However] An inflationary surge of this type must work either through the banking system or through non-bank institutions that act like banks which are often called “shadow banks”. The process toward inflation in both cases is a necessary increasing cycle of borrowing and lending. As of today, that private market mechanism has been acting as a brake on the normal functioning of the monetary engine.

For example, total commercial bank loans have declined over the past 1, 3, 6, and 9 month intervals. Also, recent readings on bank credit plus commercial paper have registered record rates of decline. The FDIC has closed a record 52 banks thus far this year, and numerous other banks are on life support. The “shadow banks” are in even worse shape. Over 300 mortgage entities have failed, and Fannie Mae and Freddie Mac are in federal receivership. Foreclosures and delinquencies on mortgages are continuing to rise, indicating that the banks and their non-bank competitors face additional pressures to re-trench, not expand. Thus far in this unusual business cycle, excessive debt and falling asset prices have conspired to render the best efforts of the Fed impotent.

Ellen Brown argues that the break down in the securitized loan markets (especially CDOs) within the shadow banking system dwarfed other types of lending, and argues that the collapse of the securitized loan market means that deflation will – with certainty – continue to trump inflation unless conditions radically change.

Support for Brown’s argument comes from several sources.

As the Washington Times notes:

“Congress’ demand that banks fill in for collapsed securities markets poses a dilemma for the banks, not only because most do not have the capacity to ramp up to such large-scale lending quickly. The securitized loan markets provided an essential part of the machinery that enabled banks to lend in the first place. By selling most of their portfolios of mortgages, business and consumer loans to investors, banks in the past freed up money to make new loans. . . .“The market for pooled subprime loans, known as collateralized debt obligations (CDOs), collapsed at the end of 2007 and, by most accounts, will never come back. Because of the surging defaults on subprime and other exotic mortgages, investors have shied away from buying the loans, forcing banks and Wall Street firms to hold them on their books and take the losses.”

Senior economic adviser for UBS Investment Bank, George Magnus, confirms:

The restoration of normal credit creation should not be expected, until the economy has adjusted to the disappearance of shadow bank credit, and until banks have created the capacity to resume lending to creditworthy borrowers. This is still about capital adequacy, where better signs of organic capital creation are welcome. More importantly now though, it is about poor asset quality, especially as defaults and loan losses rise into 2010 from already elevated levels.

And McClatchy writes:

The foundation of U.S. credit expansion for the past 20 years is in ruin. Since the 1980s, banks haven’t kept loans on their balance sheets; instead, they sold them into a secondary market, where they were pooled for sale to investors as securities. The process, called securitization, fueled a rapid expansion of credit to consumers and businesses. By passing their loans on to investors, banks were freed to lend more.

Today, securitization is all but dead. Investors have little appetite for risky securities. Few buyers want a security based on pools of mortgages, car loans, student loans and the like.

“The basis of revival of the system along the line of what previously existed doesn’t exist. The foundation that was supposed to be there for the revival (of the economy) . . . got washed away,” [economist James K.] Galbraith said.

Unless and until securitization rebounds, it will be hard for banks to resume robust lending because they’re stuck with loans on their books.

Credit Still Constrained

US credit has shrunk at Great Depression rate prompting fears of double-dip recession:

Professor Tim Congdon from International Monetary Research said US bank loans have fallen at an annual pace of almost 14pc in the three months to August (from $7,147bn to $6,886bn).

"There has been nothing like this in the USA since the 1930s," he said. "The rapid destruction of money balances is madness."

The M3 "broad" money supply, watched as an early warning signal for the economy a year or so later, has been falling at a 5pc annual rate.

Similar concerns have been raised by David Rosenberg, chief strategist at Gluskin Sheff, who said that over the four weeks up to August 24, bank credit shrank at an "epic" 9pc annual pace, the M2 money supply shrank at 12.2pc and M1 shrank at 6.5pc...

US banks are cutting lending by around 1pc a month. A similar process is occurring in the eurozone, where private sector credit has been contracting and M3 has been flat for almost a year.

The Independent notes:

A second credit squeeze and a £200bn national "funding gap" threatens to sabotage the recovery in the British economy, the IMF warned yesterday.

In its latest Global Financial Stability Report, the fund said that a combination of a soaring government deficit and the borrowing needs of British companies and consumers – coupled with a still broken banking system – would leave the UK with a national "funding gap" of 15 per cent of GDP, or around £200bn next year, much higher than in either the US or the euro area.

Housing

Moody's forecasts that housing won't return to pre-bust levels until 2020, "Florida and California will only regain their pre-bust peak in the early 2030s"

Treasury says millions more foreclosures are coming.

Fannie Mae's serious delinquency rate is skyrocketing.

Half of all borrower who are getting help with loan modifications end up redefaulting.

And apartment rental prices are falling world-wide.

Business

The creation of small businesses is way down.

Experts are projecting unprecedented corporate defaults.

Ghost fleets of unused ships lie rusting in port.

States

State tax revenues have plunged 17%.

More Signs of Deflation

Bloomberg writes:

The U.S. faces the possibility of deflation for the first time since the Eisenhower administration...

Consumer prices are experiencing deflation, with the consumer price index sliding for six straight months from year- earlier levels, the longest stretch of declines since a 12-month drop from September 1954 to August 1955, according to the Labor Department...

While the economy contracted 2.7 percent during the 1953 recession, it shrank 3.8 percent in the current recession, the most since the 1930s. Economists at New York-based JPMorgan Chase & Co. and Goldman Sachs Group Inc., the second- and fifth- biggest U.S. banks by assets, say there’s so much deflationary excess labor and plant capacity in the economy that the Fed won’t raise interest rates until at least 2011.

Paul Krugman writes:

A new report from the International Monetary Fund shows that the kind of recession we’ve had, a recession caused by a financial crisis, often leads to long-term damage to a country’s growth prospects. “The path of output tends to be depressed substantially and persistently following banking crises.”

The U.S. Census Bureau reports that 40 million Americans are living in poverty.

AP writes:

As in the 1980s, much of that shift will be driven by baby boomers. For the 78 million people born from 1946 through 1964, the Great Recession hit at a particularly inopportune time – during peak years of earning and saving before retirement. Boomers range from 44 to 63 today – the youngest is nearly 10 years older than the oldest was in 1982. They are running out of time and are most likely to remain cautious spenders and become aggressive savers even as the economy improves.

The housing bubble mistakenly led boomers and millions of others to believe their home was their retirement nest egg. If they left their home equity alone during the boom, they've taken a hit the last couple years but are still ahead. But many treated their home like a personal bank and spent the gains by tapping a home equity line of credit.

Alix Partners finds:

While American industry is struggling to get through what could become the worst recession since the Great Depression, Americans say that even after the recession ends, their spending will return to just 86% of pre-recession levels, which would take a trillion dollars per year out of the U.S. economy for years to come. According to this in-depth survey of more than 5,000 people, Americans plan to save (and therefore not spend) an astounding 14% of their total earnings post-recession, with the replenishment of their 401(k) and other retirement savings leading the way among their biggest long-term concern.

As Huffington Post notes:

"There will be a fundamental shift in the kind of cars we buy, a fundamental shift in the homes we buy, and a fundamental shift in consumption generally," says Matt Murray, an economist at the University of Tennessee. "And that is not something that took place in the 1980s."

Fed Paying Interest on Reserves

And Naufal Sanaullah writes:

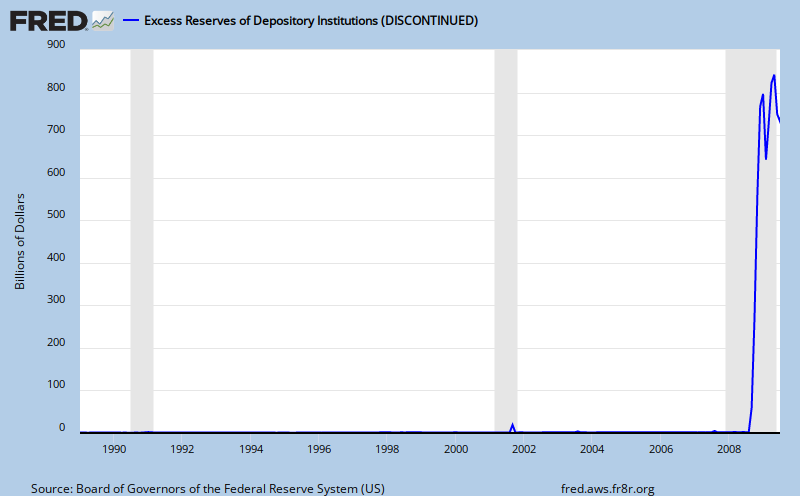

So if all of this printed money is being used by the Fed to purchase toxic assets, where is it going?

Excess reserves, of course. Counting for $833 billion of the Fed’s liabilities, the reserve balance with the fed has skyrocketed almost 9000% YoY. Excess reserves, balances not used to satisfy reserve requirements, total $733 billion, up over 38,000%!

The Fed pays interest on these reserves, and with an interest rate (return on capital) comes opportunity cost. Banks hoard the capital in their reserves, collecting a risk-free rate of return, instead of lending it out into the economy. But what happens as more loan losses occur and consumer spending grinds to a halt? The Fed will lower (or get rid of) this interest on reserves.

And that is when the excess liquidity synthesized by the Fed, the printed money, comes rushing in and inflates goods prices.

Of course, most people who are arguing we will have deflation for a while believe that we might eventually get inflation at some point in the future.

No comments:

Post a Comment

→ Thank you for contributing to the conversation by commenting. We try to read all of the comments (but don't always have the time).

→ If you write a long comment, please use paragraph breaks. Otherwise, no one will read it. Many people still won't read it, so shorter is usually better (but it's your choice).

→ The following types of comments will be deleted if we happen to see them:

-- Comments that criticize any class of people as a whole, especially when based on an attribute they don't have control over

-- Comments that explicitly call for violence

→ Because we do not read all of the comments, I am not responsible for any unlawful or distasteful comments.