I believe that physical gold is a reasonable investment right now based on the following factors: 1) sovereign defaults; 2) shortages of physical deposits; 3) the dollar; 4) central banks; 5) declining production; 6) inflation; 7) deflation; 8) uncertainty and distrust in government; and 9) flight to safety.

Sovereign Defaults

Iceland, Dubai, Greece, Portugal, Spain ...

The list of potential sovereign defaults just keeps growing.

CNBC writes:

Gold hit a 2010 high above $1,180 an ounce in Europe on Friday, fueled by euro strength and investors continuing to embrace the metal's safe-haven properties on unease over euro zone sovereign debt levels.

***

Credit ratings downgrades of Greece, Spain and Portugal unleashed a wave of risk aversion, channeling money into gold....

The fear of contagion was clearly evident in gold

As Marc Faber said in February:

The governments of every developed economy will eventually default on their sovereign debts, so the one thing he will never do in his life is 'sell my gold.'Similarly, Nouriel Roubini said today that sovereign defaults could lead to inflation:

Potential defaulter include the US, the UK and Western Europe.

Speaking to CNBC in a live interview via telephone, Faber said: "In the developed world we have huge debt to GDP, in terms of government debt to GDP and unfunded liabilities that will come due."

"These unfunded liabilities are so huge that eventually these governments will all have to print money before they default," he added.

Nouriel Roubini, the New York University professor who forecast the U.S. recession more than a year before it began, said sovereign debt from the U.S. to Japan and Greece will lead to higher inflation or government defaults.As discussed below, inflation is usually considered bullish for gold prices. And defaults would lead to uncertainty and increased distrust in government, which are bullish as well.

Shortage of Physical Deposits

As whistleblower Andrew Maguire - a London metals trader formerly of Goldman Sachs - says, gold and silver bullion markets are rigged (and see this).

Omnis' Jim Rickards, GATA's Adrian Douglas and others have demonstrated that the big bullion dealers and ETFs don't have nearly as much as physical bullion as they claim.

Should a substantial portion of investors in these vehicles demand physical delivery at the same time, it could cause a panic in the gold market which would cause a huge run up in gold prices.

The DollarWhile the inverse correlation between the dollar and gold occasionally breaks down, it usually holds true. As Jonathan Ratner notes:

Those that follow the gold and currency markets know that the price of bullion and the U.S. dollar typically move in opposite directions. However, this negative correlation can turn positive from time to time and is happening now.Jim Rickards argues that the dollar will eventually be devalued to half of its current value, so that America can afford to service its debt (a declining dollar means that America's debt can be paid back in cheaper dollars, so the debt costs less in real terms).

***Historically, episodes of U.S. dollar appreciation coupled with rising gold prices tend to be fleeting, according to Stéfane Marion, chief economist and strategist at National Bank Financial.

In a note to clients he wrote, "...we still think that the historical negative correlation between gold and the greenback will resume once the uncertainty is lifted about the introduction of credible loan programmes between eurozone partners to help certain members reduce their fiscal deficits."

***

According to Deutsche Bank, gold has decoupled from the dollar since at least the end of March.

While the dollar might rally in another stock market crash, the long-term trend of the dollar is strongly downward, favoring gold.

China, India, Russia and Other Gold Buyers

As Lawrence Williams wrote Tuesday, gold sales by central banks are virtually-nonexistent.

In fact, many central banks are buying large quantities of the shiny yellow metal.

Commentators such as Ambrose Evans-Pritchard and Byron King argue that China's hunger for gold will put a floor on gold prices. Specifically, they argue that China will "buy the dips" in gold prices, effectively putting a minimum on how low gold prices can go.

Indeed, former chief Merrill Lynch economist David Rosenberg argues that because China will buy a lot of gold, gold will shoot to $2,600/ounce.

In December, Goldman Sachs predicted that gold will shoot past $1,400/ounce by 2011, largely on the basis of central banks becoming net buyers of gold, gold ETFs continuing to buy substantial volumes, and real estate prices being depressed.

As Reuters India noted on March 29th:

China's gold demand is expected to double over the next decade due to jewellery consumption and investment needs, the World Gold Council (WGC) said in its first report on the world's fastest growing consumer of the metal.

***If the central bank boosts gold holdings to 2.2 percent of forex reserves, a peak level seen in 2002, from the current 1.6 percent, China's total incremental demand would rise by 400 tonnes at the current gold price, the WGC report said.

China's share of global gold demand doubled from 5 percent in 2002 to 11 percent in 2009, and the council predicted that China's domestic gold mines could be exhausted within six years.

"The Chinese gold industry is simply not responding fast enough to bring in new supply," it said.

And see this.

India's central bank has also bought large amounts of gold, and Russia is said to be looking to buy gold as well.

Even small countries such as Sri Lanka and Mauritius are buying large quantities of gold.

Declining Production

China is not the only country facing declining gold production.

The world's biggest gold producer - Barrick - says that the relatively easy-to-reach gold supplies are gone, and so supplies are getting more and more expensive to locate and extract:

Mining-Technology.com stated in March 2008:Aaron Regent, president of the Canadian gold giant [Barrick], said that global output has been falling by roughly 1m ounces a year since the start of the decade. Total mine supply has dropped by 10pc as ore quality erodes, implying that the roaring bull market of the last eight years may have further to run.

"There is a strong case to be made that we are already at 'peak gold'," he told The Daily Telegraph at the RBC's annual gold conference in London.

"Production peaked around 2000 and it has been in decline ever since, and we forecast that decline to continue. It is increasingly difficult to find ore," he said.

Global gold production has been in steady decline since 2002. Production in 2007 was around 2,444t, down 1% on the previous year.

Analysts note that virtually all of the low-lying fruit has now been picked with respect to gold, meaning that companies will have to take on more challenging and more expensive projects to meet supply. The extent to which the current high price of gold can translate into profits remains to be seen...

According to Bhavesh Morar, national leader of the mining, energy and infrastructure group with Deloitte Australia, frenzied exploration activity over the last few years has seen virtually all of the easy harvest been picked with respect to gold...

The high price of gold is however encouraging more adventurous projects, be they more challenging financially, geologically, geopolitically or all three. New projects for gold and other resources are mushrooming throughout Africa, China, the Middle East and the former Soviet Union; all areas where sovereign risk is potentially very high.

Zeal Speculation and Investment wrote last July:

Miners have the same geological landscape to work with today as those miners thousands of years ago. The only difference is the low-hanging fruit has already been picked. Gold producers must now search for and mine their gold in locations that may not be very amenable to mining. Many of today’s gold mines are located in parts of the world that would not have even been considered in the past based on geography, geology, and/or geopolitics.

And these factors among many are attributable to an alarming trend we are seeing in global mined production volume. According to data provided by the US Geological Survey, global gold production is at a 12-year low. And provocatively this downward trend has accelerated during a period where the price of gold is skyrocketing.

You would think that with the price of gold rising at such a torrid pace gold miners would ramp up production in order to profit from this trend. But as you can see in this chart this has not been the case, at all. Not only has gold production not responded, but it has dropped at an unsightly pace that has sent shockwaves throughout the gold trade.

As the red line illustrates gold’s secular bull began in 2001, finally changing direction after a long and brutal bear market drove down prices to ridiculous lows in the $200s. To match this bull the blue-shaded area provides a picture of the corresponding global production trend. And you’ll notice that in the first 3 years of gold’s bull production was steady. This is not a surprise as you figure it would take the producers a few years to ramp up supply. But instead of supply increasing in response to growing demand and rising prices, it took a turn to the downside. And what’s even more amazing is the persistence of this downtrend. Since 2001 gold production is down a staggering 9.3%! In 2008 there were 7.7m fewer ounces of gold produced than in 2001.

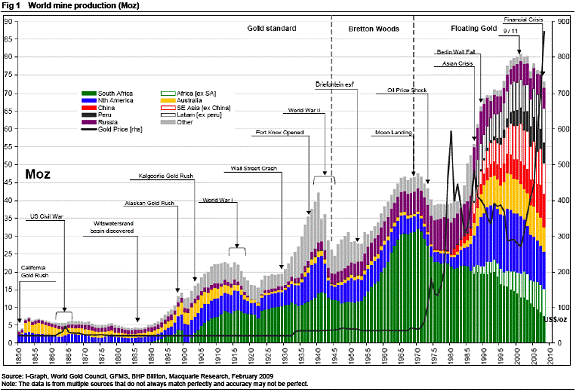

Also in July, Whiskey and Gunpowder posted a chart on historical gold production, and argued for decreasing production:

Take a look at the chart below from Macquarie Research, depicting world gold production 1850-2008...

[Click here for full chart]

For example, look at the very steep rise in gold output during the 1930s. That was during the depths of the worldwide Great Depression.

In both the US/Canada (blue area), and the rest of the world (gray area), people were digging more and more gold. The Soviets (purple area) increased their gold output too, courtesy of Joseph Stalin and his Gulag. Desperate times call for desperate measures, I suppose. Will that sort of history repeat this time around?

Or look at that massive run-up in gold output from South Africa (green area) in the 1950s and 1960s. That was during a time when South Africa was instituting its post-World War II system of apartheid. Labor was cheap (sorrowfully cheap), and quite a lot of international investment poured into South Africa without moral qualm. The South Africans dug deep and just plain tore into those gold-bearing reef structures of the Witwatersrand Basin.

But notice how quickly the South African gold output declined in the 1970s, as the mines got REALLY deep and the rest of the world began to institute sanctions against South Africa over its apartheid system.

And then look at the Gold Price run-up that followed in the late 1970s. It was a time of inflation, mainly coming from the US Dollar. Yet world gold mine output was dropping as well. Falling output, plus monetary inflation? The Gold Price skyrocketed. Another bit of useful history, right?

Now let's focus on more recent history, since about 1990. There were large increases in gold output from the US/Canada (blue), Australia (gold) and Asia (China orange, non-China open bar). By 2000 or so – the world production peak – Gold Prices were down toward $300 per ounce and below.

But as the chart shows, in the past 10 years, gold output has shown a marked DECLINE in the major historic Gold Mining regions. The prolific gold output from the US/Canada, Australia and South Africa has followed downward trends. Sure, these regions still lift a lot of ore and pour a lot of melt. But the production trend is DOWN.

The US/Canada, Australia and South Africa all have well-established and (more or less) workable mining laws – despite the best efforts of many current politicians and regulators to screw it all up. These historically producing areas are politically stable. Overall, there's good mining infrastructure, with road and rail networks, power systems, refining plants, a vendor base, mining personnel and access to capital.

But that's not the case in many areas of the developing parts of the world. Political stability? Security? Infrastructure? Transport? Power? Refining? Vendors? Personnel? Capital? Everywhere is different, of course. But overall, the entire process is much more problematic. So there's a lot more risk. When you move away from the traditional mining jurisdictions, the whole process of exploration, development and mining is more expensive.

Thus, the new gold discoveries of the future are going to lack some (if not most, or perhaps all) of the advantages of the developed mining world. That means that the ore deposits of the future will have to offer much higher profit margins, based on size and ore grade, to compensate for the increased risks. Too bad Mother Nature (or Saint Barbara, who looks after miners) doesn't work that way.

It also means the timeline to develop the mines of the future will likely be stretched over many years while political, legal, bureaucratic, logistical and social issues are ironed out.

The key driver for the future of worldwide gold supply will be DECLINING output overall over time.

Of course, if the price of gold warrants ramping up, then production will increase. Just as with discussions about peak oil, the issue is not that the resource is totally running out, it is that it will be more and more expensive to extract.

Inflation

It is conventional wisdom that gold is a hedge against inflation.

For example:

- Noted inflationist John Williams advises buying gold

- Axel Merk argues that gold is a better buy than TIPS as an inflation bet

- Nassim Taleb advised buying gold, since currencies including the dollar and euro face pressures

John Paulson argues that gold is something you buy-and-hold for at least the medium term:

Paulson is convinced that gold will be a very good way to protect himself from the eventuality of currency debasement (i.e., inflation). He observed that if one thinks about gold in a three- or five-year time horizon (instead of hour to hour, day to day or week to week), the probability increases of gold being higher over time...

Deflation

If gold does well during times of inflation, it makes sense that it would perform poorly during deflationary periods.

But Examiner.com points out that such an assumption is probably untrue. Specifically, as Examiner.com writes:

Eric Sprott - who manages $4.5 billion in assets, and correctly predicted in March of 2008 a "systemic financial meltdown” - says:“I believe no matter what environment you’re in - deflation or inflation - people will run to gold,” Sprott said. “Gold is proving exactly what we all would have expected, that in almost any environment, it’s a go-to asset.”

Investment analyst and financial writer Yves Smith argues that gold does well during both periods of deflation and high inflation. She argues:

Historically, gold does well [in] hyperinflation and deflationary [periods]. Gold does poorly under more normal conditions, and gets hammered in disinflationary conditions, a falling but positive rate of inflation.

Analyst Adrian Ash argues that gold's value actually increases during periods of deflation even if its price drops:

Does the price of gold rise or fall in a deflation?In other words, Ash argues that you can't take inflation or deflation in a vacuum. During deflationary periods, governments always increase the money supply with a flood of new dollars, which is bullish for gold.Hint: It’s a trick question, already tripping up plenty of would-be advisors...

Absent the money-supply limits which the gold standard imposed on the world, people rightly guess that double-digit inflation would prove rocket-fuel for the bull market in gold. Yet the purchasing power of gold nearly doubled during the Great Depression, and it’s risen four-fold during this decade’s low consumer-price inflation as well.Why? Because both those periods of low price-inflation saw the money-issuing authorities devalue the currency, first with explicit reference to gold but now without daring to name it. Roosevelt in the mid-30s slashed the dollar’s gold content by 40%; the Greenspan/Bernanke Fed devalued the Dollar again to sidestep a DotCom Depression, keeping real interest rates at less than zero, between 2002-2005.

The maestro’s apprentice applied the same trick in the back-half of 2008, but so far to no avail. And now even the European Central Bank is pumping out money – a near half-trillion euros today alone – in a bid to revive bank lending, swamp the currency markets, and pull Germany out of its first flirt with deflation since the 1930s.

Just such a devaluation – and again, absent any stated reference to gold – was attempted by the Bank of Japan a little less than a decade ago.

Indeed, Japan is the only developed nation since the end of the gold standard to have suffered an extended deflation in prices. So far, at least. Germany and Switzerland look set to try for a re-wind, and unless the dollar can outpace the euro’s descent, we might yet see truly sub-zero inflation in the United States, too.

But whatever that should mean for gold prices, all other things being equal, just doesn’t matter. Because the gold price will not get a chance. All other things are not equal, and the policy solution – rank devaluation – can only make gold more appealing to investors and savers, whether the “monetarist experiment” of TARP, quantitative easing or a half-trillion euros proves successful or not.

Japan’s slump into deflation coincided with the Bank of Japan’s “zero interest rate policy” (ZIRP) at the start of this decade. It also saw the gold price worldwide hit rock-bottom and turn higher, a move that analysts (including us) have typically linked to US monetary moves and investment cash looking for safety as the Dotcom Bubble exploded.

But zero-rate money from the world’s second-largest economy shouldn’t be ignored. And today, zero-rate money is all the developed world has to offer – a trick that might not beat deflation, but might just spur a whole new rush into gold.

And economist Marc Faber wrote in October 2007 that gold will do well even in a deflation:

How would gold perform in a deflationary global recession? Initially gold could come under some pressure as well but once the realization sinks in how messy deflation would be for over-indebted countries and households, its price would likely soar.

Therefore, under both scenarios - stagflation or deflationary recession - gold, gold equities and other precious metals should continue to perform better than financial assets.

Is Faber right?

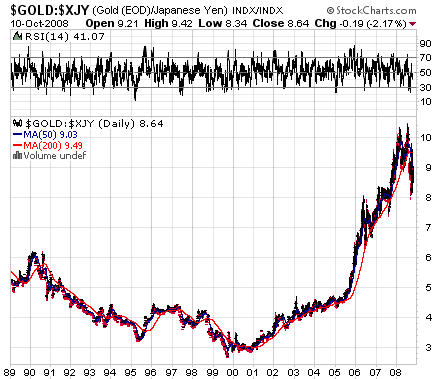

Well, take a look at the following charts showing gold's performance as compared to the yen during Japan's "lost decade" of deflation:

Japan's deflation didn't definitively end until 2007 or 2008.

This provides some evidence that gold may tend to hold or increase its value at least in the later part of the deflationary period as compared with the relevant national currency.

Moreover - approximately half the time - gold has risen during recessions in the United States:

(The grey vertical bars show periods of recession; the chart gives gold prices in monthly averages; click here for larger image).

If you study the above chart, you will see that gold seems to often fall during the beginning stages of a recession, then rise in the later stages of the recession (before 1971, the dollar was still backed by gold at a fixed price, and so gold did not fluctuate).

But what about Ash's theory?

The American Enterprises Institute notes:

After five years in a deflationary economic wilderness, the Bank of Japan switched during the spring of 2001 to a policy of quantitative easing--targeting the growth of the money supply instead of nominal interest rates--in order to engineer a rebound in demand growth.

Look again at the first gold chart for Japan, above. Gold appears to start increasing against the Yen in 2001.

This may provide some evidence for Ash's thesis that it is an expansion of the money supply which pushes the price of gold up in the later stages of deflationary periods.

See also Fred Sheehan's summary of Roy Jastram's study of the performance of gold during deflationary periods throughout history.

Uncertainty

Former chief Merrill Lynch economist David Rosenberg writes:

The gold price ... is trending higher in U.S. dollar terms and surging in Euro terms and is a hedge against financial instability.

Chris Martenson argues that - in prolonged periods of deflation - we usually see failures of large and significant banks, institutions, and perhaps even states and countries. (Because gold traditionally does well during periods of uncertainty, Martenson likes gold during periods of deflation).

Examiner.com notes in a subsequent article:

Merrill Lynch agrees.Specifically, PhD economist Nouriel Roubini paraphrases a report from Merill Lynch (not available online) as follows:

Short-term rates of 0% are bullish for gold, which serves as a store of value but is a useful hedge against deflation as well, since deflation is inherently destabilizing for financial assets. In the 2001-03 deflationary period, gold rose more than 30%, not to mention the prospect of a return to a dollar bear market. "Gold is inversely correlated to global short-term interest rates and there is a race right now towards 0%. Production is down 4.0% y/y while fiat currencies globally are being created at a double digit rate by the world's central banks....As for all the talk of a 'gold bubble,' it would take a nearly 625% surge in gold to over US$6,000/oz and a flat stock market to actually get the ratio of the two asset classes back to where it was three decades ago when bullion was in an unsustainable bubble phase."

Gold tends to be less sensitive to global economic slowdown than industrial metals or energy and works better as a hedge against crisis than inflation.

(If global short-term interest rates rise, that would obviously be bearish for gold.)

Distrust in GovernmentTime Magazine writes:

Traditionally, gold has been a store of value when citizens do not trust their government politically or economically.

Given the enormous levels of distrust in government politically and/or economically in the U.S. and globally, gold might do well. (and see this.)

Also, as mentioned above, gold tends to do well during periods of uncertainty. Given that the fundamental problems with the economy have not been fixed, things will likely become less certain.

Greenspan and Exeter

Professor Emeritus of Mathematics Antal Fekete has argued for years that gold is the ultimate - and only - safe haven when things really hit the fan.

For example, in 2007 Fekete wrote:

The grand old man of the New York Federal Reserve bank’s gold department, the last Mohican, John Exter explained the devolution of money (not his term) using the model of an inverted pyramid, delicately balanced on its apex at the bottom consisting of pure gold. The pyramid has many other layers of asset classes graded according to safety, from the safest and least prolific at bottom to the least safe and most prolific asset layer, electronic dollar credits on top. (When Exter developed his model, electronic dollars had not yet existed; he talked about FR deposits.) In between you find, in decreasing order of safety, as you pass from the lower to the higher layer: silver, FR notes, T-bills, T-bonds, agency paper, other loans and liabilities denominated in dollars. In times of financial crisis people scramble downwards in the pyramid trying to get to the next and nearest safer and less prolific layer underneath. But down there the pyramid gets narrower. There is not enough of the safer and less prolific kind of assets to accommodate all who want to "devolve”. Devolution is also called "flight to

safety”.

Darryl Schoon makes the same argument.

Here's a visual depiction Exeter's inverted pyramid, courtesy of FOFOA:

(Click here for full image; I can't vouch for the accuracy of the rankings for all of the levels . . . for example, muni bonds versus corporate bonds)

Last September, Alan Greenspan lent some support to the theory. Specifically:

Gold prices that jumped above $1,000 an ounce this week are signaling that investors are buying metals to hedge against declines in currencies, former Federal Reserve Chairman Alan Greenspan said.

The gains are “strictly a monetary phenomenon,” Greenspan said today at an investment conference in New York. Rising prices of precious metals and other commodities are “an indication of a very early stage of an endeavor to move away from paper currencies,” he said...

“What is fascinating is the extent to which gold still holds reign over the financial system as the ultimate source of payment,” Greenspan said.

In other words, Greenspan is saying that investors are moving out of the second-to-lowest step on the pyramid (currencies and government bonds) and into the lowest step (gold).

Greenspan is also verifying what goldbugs like Exeter, Fekete and Schoon have been claiming: that "the barbarous relic" still holds an important place in the modern investor's psyche.

Indeed, Tyler Durden and David Goldman argue that the response of investors to the PIIGS' debt crisis shows that Exeter is right, and that the shift from currencies to gold is already occurring.

Only time will tell if they are right.

Note: I am not an investment advisor and this should not be taken as investment advice.

"Physical gold" -is THAT the stuff, WITH or WITHOUT the Tungsten core? LOL!

ReplyDeleteAnd just -where are "investors" in physical gold supposed to keep their hoard of the obviously-precious-yellow-metal -where the baby-sitter or one of your daughters' many horny, ambitious, but also rotten-to-the-core boyfriends won't find it?

My advice for investors is to avoid being enticed into parting with your -real money- in exchange for anything that you cannot personally use, and -use- frugally in these tough economic times.

The miserly approach pays a strong regular dividend in a deflationary time as we are clearly in.

Economists in the know will tell you, all the black numbers we're constantly hearing about in the economy are actually highly subsidized and inflated by the government-hires who have been told to cook-up those black numbers because an election is coming.

I make this advice concerning investing, because in a deflationary market, it is tough to sell ANYTHING for what some very-practiced-at-swindling-high-pressure-salesman-broker-being-paid-straight-commission might tell you what-ever-it-is is worth as he's relieving you of your real money -he covets.

You'll never meet a more obnoxious, lying -den of thieves and liars -in any other line of work- than these gold brokers who make money off the fears and the susceptibility to fraud of the gullible.

After all, think about it -lots of very knowledgeable "investment" people apparently bought Tungsten-filled Gold bars. I wonder, what they are worth today.

And -I wonder what makes anyone think they are smarter than those dupes, when some of THEM are handling the Harvard endowment.

Gold is the likeliest of cons in a thousand different ways. That has always been true.

SO, ------->>>>LOOK-OUT!

Beware of any paper GOLD investments. This story should get much more traction on the blogs and media. Madoff was a little lamb compared to these fraudsters. Please pass it on and expose them for what they really are:

ReplyDeleteWhistle Blower Comes Forward With Solid Proof The Price Of Gold And Silver Is Being Manipulated By Major Financial Institutions

April 12, 2010

http://www.inteldaily.com/2010/04/gold-manipulation/

Really great analysis thanks for sharing this information. :)

ReplyDeleteas you can see in this chart this has not been the case, at all. Not only has gold production not responded, but it has dropped at an unsightly pace that has sent shockwaves throughout the gold trade.

ReplyDelete==================================

Cheap Investors

Thanks very much.. Gold now a days getting better and better..Pension Finder

ReplyDeleteThanks for info !

ReplyDeleteActually, gold is the right investment for money. Its sure that gold rate would be rise with the time and we get lot of benefit from it. Last month, I bought 10 gold biscuit for the purpose of investment.

ReplyDeletettp://www.vintageyard.com/