The Washington Post notes:

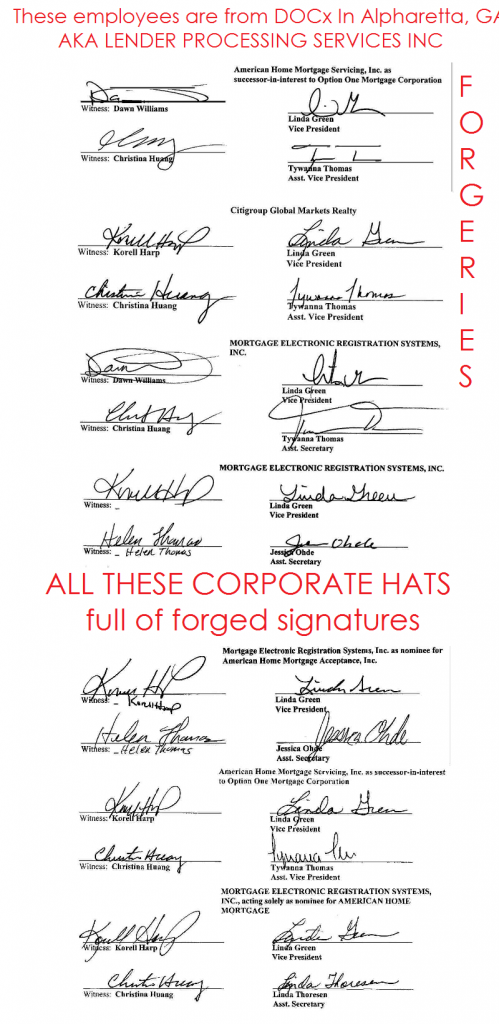

In Georgia, an employee of a document processing company, Linda Green, for years claimed to be executives of Bank of America , Wells Fargo, U.S. Bank and dozens of other lenders while signing off on tens of thousands of foreclosure affidavits. In many cases, her signature appeared to be forged by different employees.

Green worked for a foreclosure document company owned by Lender Processing Services. The company is being investigated by a U.S. attorney in Florida for allegedly using improper documentation to speed foreclosures.

Lenders have already started to withdraw foreclosures that had Green's name on them.

Green also submitted to courts documents that listed "Bogus Assignee" as the owner of a mortgage instead of the real name. In another case, she signed as the vice president of "Bad Bene," a made-up company.

***"There are procedures to be followed in order to get a foreclosure, and you either get it right or not. Either you're pregnant or not. There's no in-between," [Arthur M. Schack, a Kings County Supreme Court judge in Brooklyn,] said

Foreclosure attorney Lynn Szymoniak located numerous signatures of "Linda Green" from pleadings filed in various courts.

StopForeclosureFraud.com has rounded up some examples of "Linda Green's" signatures in one image:

In February 2010, 4ClosureFraud.org posted one of Green's signatures on an assignment of title to "Bogus Assignee":

(And here are numerous other assignments to "Bogus Assignee" signed by Green, start with the fourth document down.)

Szymoniak pointed out in July:

There are examples of the many different Linda Green signatures/forgeries. Green’s “signature” appears on HUNDREDS OF THOUSANDS of mortgage assignments – as an officer of at least 20 different banks and mortgage companies.Doing the Math

The total mortgage loan amount on 500 “Linda Green” Mortgage Assignments is $126,956,912, or approximately $125 million for each 500 Assignments. The average output of Assignments from the Docx office in Alpharetta [Green's actual employer], Georgia in 2009 was 2,000 Assignments per day.

This would be equivalent to (4 x $125 million) or $500 million each day. Assuming that Docx operated 5 days a week for 51 weeks (allowing for holidays), the office was open, producing Assignments, 255 days. It is likely that the Linda Green/Docx crew prepared and filed Mortgage Assignments showing One Hundred Twenty-Seven Billion, Five Hundred Million ($127,500,000,000) in mortgages were Assigned in 2009.

Remember also that Mortgage Electronic Registration Systems - which Green repeatedly signed for - is itself a shell company which holds 60% of all American residential mortgages.

DocX is also the company which published price lists for forging documents, including such gems as:

"Create Missing Intervening Assignment" $35

"Cure Defective Assignment" $12.95

"Recreate Entire Collateral File" $95

Given the above, it is clear why the Florida Attorney General has issued a subpoena to Linda Green's real employer - DocX - requesting the following documents:

2. Copies of any and all underlying documentation that allows for your employee or ex-employee, Linda Green to sign documents in the following capacities:

a. Vice President of Loan Documentation, Wells Fargo Bank, N.A. successor by merger to Wells Fargo Home Mortgage, Inc.;

b. Vice President, Mortgage Electronic Registration Systems, Inc. as nominee for American Home Mortgage Acceptance, Inc.;

c. Vice President, American Home Mortgage Servicing as successor-in-interest to Option One Mortgage Corporation;

d. Vice President, Mortgage Electronic Registration Systems, Inc. as nominee for American Brokers Conduit;

e. Vice President & Asst. Secretary, American Home Mortgage Servicing, Inc., as servicer for Ameriquest Mortgage Corporation;

f. Vice President, Option One Mortgage Corporation;

g. Vice President, Mortgage Electronic Registration Systems, Inc. as nominee for HLB Mortgage;

h. Vice President, American Home Mortgage Servicing, Inc.;

1. Vice President, Mortgage Electronic Registration Systems, Inc. as nominee for Family Lending Services, Inc.;

J. Vice President, American Home Mortgage Servicing, Inc. as Successor -ininterest to Option One Mortgage Corporation;

k. Vice President, Argent Mortgage Company, LLC by Citi Residential Lending, Inc., attorney-in-fact;

1. . Vice President, Sand Canyon Corporation f/kJal Option One Mortgage Corporation;

m. Vice President, Amtrust Funsing (sic) Services, Inc., by American Home Mortgage Servicing, Inc., as Attorney-in -fact;

n. Vice President, Seattle Mortgage Company.

3. Copies of every document signed in any capacity by Linda Green.

Of course, its not just Linda Green.

As Szymoniak points out:

The offices of Lender Processing Services in Mendota Heights, Minnesota, seems likely to also have produced 2,000 Assignments each working day.Jeffrey Stephan from the GMAC offices in Montgomery County, Pennsylvania also is likely to have produced 2,000 Assignments each day.

Bryan Bly of Nationwide Title Clearing also is likely to have produced 2,000 Mortgage Assignments each day.

Scott Anderson of Ocwen Loan Servicing in West Palm Beach, Florida, almost certainly produced an average of 2,000 Assignments a day.

Herman John Kennerty of America’s Servicing Company in Ft. Mill, South Carolina, also is likely to have produced 2,000 Assignments each day.

Erica Johnson-Seck was almost certainly producing Assignments at this same level for IndyMac.

Christina Trowbridge, Whitney Cook, and Stacy Spohn of Chase Home Finance in Franklin, Ohio likely had the same output.

Keri Selman and Renee Hertzler of BAC Home Loan Servicing (formerly Countrywide) in Texas almost certainly produced an average of 2,000 Assignments a day.

If these nine offices each produced 2,000 Assignments a day, the value of the Mortgage Assignments filed by all nine offices in 2009 was One Trillion, One Hundred Forty Seven Billion, Five Hundred Million ($1,147,500,000,000).

Unbelievable. There is absolutely no way that judges can accept this cr*p on any mortgage deed put in front of them again.

ReplyDeleteThe foreclosure halt could drag on for a very long time. Millions of struggling underwater homeowners will have little incentive to continue paying.

I'm someone who is ahead in my mortgage. However, as I watch the properties around me sink in value, dragging down my own home value, I wonder: How much lower until it's not worth paying? Could I proactively try to have my mortgage declared to be crap? How would that even be done?

ReplyDeleteMortgages can be difficult and a bit overwhelming!

ReplyDeleteWhat about Pat Kingston, I have one looks nothing like her signature for release of Deed of Trust and Release in Jefferson County Colorado, this is a Georgia Notary.

ReplyDeleteBaily Kirchner,Fulton County. Pat Kingston is a Vice President along with Jimmy Gosset also a Vice President.

in behalf of MERS as nominee for --- in Virginia, my --- connection is in Lewisville, Texas.

When recorded to return to DOCX.

would you have those signatures in your

This is quite unbelievable. So what's going to happen to those involved in this? Surely actions must be taken. Any updates to this would be interesting reading.

ReplyDeleteJack

Webmaster of first time home buyers

Well I was looking some legal procedure and my case testimonial about Forensic Examiner Atlanta in usa so my search stopped me at your blog I enjoyed reading it. I'm supposed to be somewhere else in a minute but I stuck to reading the story. I love Your Blog……..

ReplyDeleteHey, the Fraud isn't JUST about "Linda Green"...what about those Witnesses? Those Signatures are different, too.

ReplyDeleteAnd, what about those Notaries?

What is the Penalty for Validating the "Legality" of each of these "Signings"--both Officers and Witnesses????