Thursday, August 18, 2011

Roubini: "Gold, Like US Treas Yields, Is Pricing Risk That We Go Into Another Deflationary Depression & Global Financial Meltdown, Not Inflation"

Gold Soars On Fear of Deflationary Depression

Well-known economist Nouriel Roubini tweets:

Thus gold, like US Treas yields, is pricing risk that we go into another deflationary depression & global financial meltdown, not inflation

As MarketWatch writes:

Gold futures on Thursday surpassed $1,800 an ounce on their way to a record settlement as fears of a global economic slowdown gripped markets and the day’s full slate of macroeconomic reports gave the fears even more weight.As Michael A. Gayed, - Chief Investment Strategist at Pension Partners - notes (via The Big Picture):

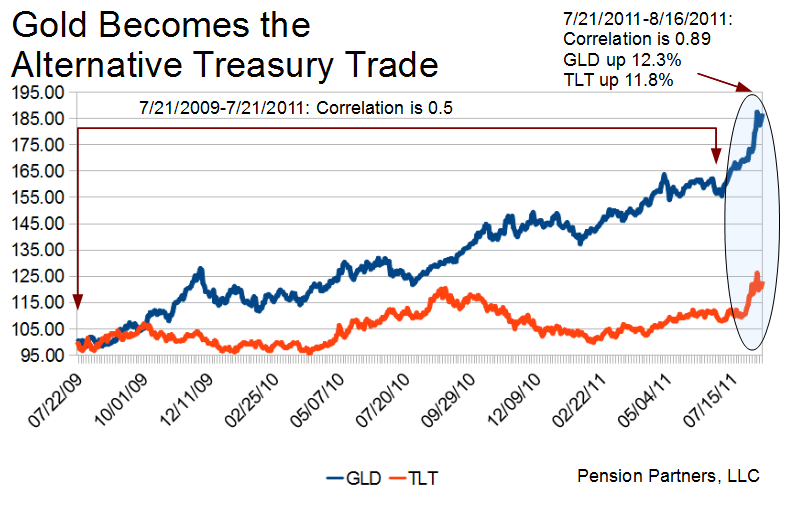

Recalculated with base of 100.>

Gold! Are a new class of investors treating it like Treasuries?

The evidence: A stunningly high correlation of Gold to 20+ Year Treasuries (Symbol: TLT) from July 21 through August 16 is 0.89. Over that period, Gold is up 12.3%, while Treasuries up 11.8% (not counting today’s spasm).

Contrast this to a correlation of 0.5 over the periods July 21, 2009 – July 21, 2011 and it appears Gold and Treasuries are now behaving as one and the same, moving in lockstep fashion. Of course, Treasuries are a much broader and deeper market, and a move in Bonds represents trillions of dollars of activity, versus Gold, which is orders of magnitude smaller.

Perhaps investors who might otherwise flock to Treasuries during risk-off modes are now flocking to Gold? After all, S&P cannot downgrade a metal…

Gold Performs Well During Later Stages of Deflation

By way of background, gold performs well during the later stages of deflation. As I explained last year:

If gold does well during times of inflation, it makes sense that it would perform poorly during deflationary periods.

But Examiner.com points out that such an assumption is probably untrue. Specifically, as Examiner.com writes:

Eric Sprott - who manages $4.5 billion in assets, and correctly predicted in March of 2008 a "systemic financial meltdown” - says:“I believe no matter what environment you’re in - deflation or inflation - people will run to gold,” Sprott said. “Gold is proving exactly what we all would have expected, that in almost any environment, it’s a go-to asset.”Investment analyst and financial writer Yves Smith argues that gold does well during both periods of deflation and high inflation. She argues:

Historically, gold does well [in] hyperinflation and deflationary [periods]. Gold does poorly under more normal conditions, and gets hammered in disinflationary conditions, a falling but positive rate of inflation.

Analyst Adrian Ash argues that gold's value actually increases during periods of deflation even if its price drops:

Does the price of gold rise or fall in a deflation?In other words, Ash argues that you can't take inflation or deflation in a vacuum. During deflationary periods, governments always increase the money supply with a flood of new dollars, which is bullish for gold.Hint: It’s a trick question, already tripping up plenty of would-be advisors...

Absent the money-supply limits which the gold standard imposed on the world, people rightly guess that double-digit inflation would prove rocket-fuel for the bull market in gold. Yet the purchasing power of gold nearly doubled during the Great Depression, and it’s risen four-fold during this decade’s low consumer-price inflation as well.Why? Because both those periods of low price-inflation saw the money-issuing authorities devalue the currency, first with explicit reference to gold but now without daring to name it. Roosevelt in the mid-30s slashed the dollar’s gold content by 40%; the Greenspan/Bernanke Fed devalued the Dollar again to sidestep a DotCom Depression, keeping real interest rates at less than zero, between 2002-2005.

The maestro’s apprentice applied the same trick in the back-half of 2008, but so far to no avail. And now even the European Central Bank is pumping out money – a near half-trillion euros today alone – in a bid to revive bank lending, swamp the currency markets, and pull Germany out of its first flirt with deflation since the 1930s.

Just such a devaluation – and again, absent any stated reference to gold – was attempted by the Bank of Japan a little less than a decade ago.

Indeed, Japan is the only developed nation since the end of the gold standard to have suffered an extended deflation in prices. So far, at least. Germany and Switzerland look set to try for a re-wind, and unless the dollar can outpace the euro’s descent, we might yet see truly sub-zero inflation in the United States, too.

But whatever that should mean for gold prices, all other things being equal, just doesn’t matter. Because the gold price will not get a chance. All other things are not equal, and the policy solution – rank devaluation – can only make gold more appealing to investors and savers, whether the “monetarist experiment” of TARP, quantitative easing or a half-trillion euros proves successful or not.

Japan’s slump into deflation coincided with the Bank of Japan’s “zero interest rate policy” (ZIRP) at the start of this decade. It also saw the gold price worldwide hit rock-bottom and turn higher, a move that analysts (including us) have typically linked to US monetary moves and investment cash looking for safety as the Dotcom Bubble exploded.

But zero-rate money from the world’s second-largest economy shouldn’t be ignored. And today, zero-rate money is all the developed world has to offer – a trick that might not beat deflation, but might just spur a whole new rush into gold.

And economist Marc Faber wrote in October 2007 that gold will do well even in a deflation:

How would gold perform in a deflationary global recession? Initially gold could come under some pressure as well but once the realization sinks in how messy deflation would be for over-indebted countries and households, its price would likely soar.

Therefore, under both scenarios - stagflation or deflationary recession - gold, gold equities and other precious metals should continue to perform better than financial assets.Is Faber right?

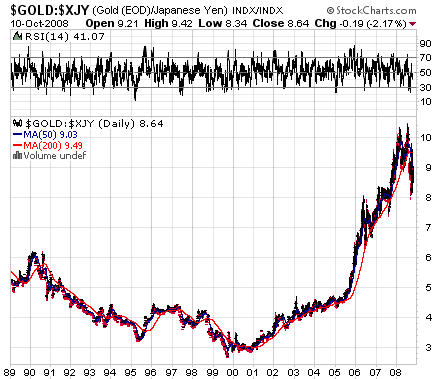

Well, take a look at the following charts showing gold's performance as compared to the yen during Japan's "lost decade" of deflation:

Japan's deflation didn't definitively end until 2007 or 2008.This provides some evidence that gold may tend to hold or increase its value at least in the later part of the deflationary period as compared with the relevant national currency.

Moreover - approximately half the time - gold has risen during recessions in the United States:

(The grey vertical bars show periods of recession; the chart gives gold prices in monthly averages; click here for larger image).

If you study the above chart, you will see that gold seems to often fall during the beginning stages of a recession, then rise in the later stages of the recession (before 1971, the dollar was still backed by gold at a fixed price, and so gold did not fluctuate).

But what about Ash's theory?

The American Enterprises Institute notes:

After five years in a deflationary economic wilderness, the Bank of Japan switched during the spring of 2001 to a policy of quantitative easing--targeting the growth of the money supply instead of nominal interest rates--in order to engineer a rebound in demand growth.Look again at the first gold chart for Japan, above. Gold appears to start increasing against the Yen in 2001.

This may provide some evidence for Ash's thesis that it is an expansion of the money supply which pushes the price of gold up in the later stages of deflationary periods.

See also Fred Sheehan's summary of Roy Jastram's study of the performance of gold during deflationary periods throughout history.

(If you don't understand how people could worry about deflation given the walls of money printed by the Fed, start here; more here. If you're surprised to hear anyone talk about a depression, get up to speed here.)

Gold Does Well During Periods of Uncertainty, Distrust and Risk Aversion

Given that the governments of the world have done nothing to fix our fundamental economic problems, the current economic crisis should not be surprising to anyone who has been paying attention. See this and this.

No comments:

Post a Comment

→ Thank you for contributing to the conversation by commenting. We try to read all of the comments (but don't always have the time).

→ If you write a long comment, please use paragraph breaks. Otherwise, no one will read it. Many people still won't read it, so shorter is usually better (but it's your choice).

→ The following types of comments will be deleted if we happen to see them:

-- Comments that criticize any class of people as a whole, especially when based on an attribute they don't have control over

-- Comments that explicitly call for violence

→ Because we do not read all of the comments, I am not responsible for any unlawful or distasteful comments.