Liberals credit John Maynard Keynes with ending the Great Depression with his stimulus programs.

Conservatives and "modern" economists credit Milton Friedman with figuring out the real cause of the Depression - too small a monetary base - and creating modern monetary policy.

But a team of UCLA economists have determined that some of FDR's policies actually prolonged the depression by 7 years. And some very smart economists credit the manufacture of armaments in World War II (especially those sold to England before America even entered the war) as the thing which really got us out of the Depression. Indeed, as discussed below, proponents of the Austrian school of economics have been saying for decades that you can't stimulate your way out of a Depression with government programs.

And nobel economist Paul Krugman points out that the data show that Bernanke's application of Friedman's monetary theory in the present crisis shows that Friedman was wrong:

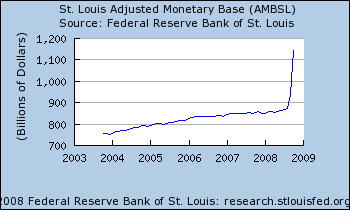

So here we are, facing a new crisis reminiscent of the 1930s. And this time the Fed has been spectacularly aggressive about expanding the monetary base:

Ben goes for brokeAnd guess what — it doesn’t seem to be workiing.

I think [Friedman's] thesis ... has just taken a hit.

(Even the co-author of Friedman's treatise on the Great Depression says that Bernanke is doing the wrong things to solve the financial crisis).

So if neither Keynes nor Friedman was right, who was?

The Austrian economists and others who said that depressions are caused by speculative bubbles and too-easy credit, and that the only way to get through them is to let businesses which made stupid decisions fail. It is painful in the short-run, in the same way that surgery to remove a small tumor is not fun but is life-saving. But we get through the slump years earlier than if the government fiddles with the economy, which almost always makes it worse.

As prominent economist Marc Faber says, the "best medicine" is to let some companies fail and to let the crisis "burn itself out" (he also says that Bernanke and Paulson's actions will prolong the economic crisis by years).

Liberals and conservatives have to let go of their pet theories and do what will actually work to shorten the time of this financial crisis - let the gamblers fail, let the markets clear out the debris from the con artists and greedheads and snake oil derivatives salesmen . . . and after a brief rough patch, the economy can right itself.

Part of the reason that Keynes and Friedman were both wrong is that the Fed was created in 1913 - years before either of them came up with their theories. The Fed has distorted the economy and the free market. We need to abolish the Fed and let the markets work.

The Law of Institutional Existence:

ReplyDeleteThe primary purpose in the creation of all institutional entities is to fulfill a need; be it an organization, a church, or a corporation.

Once created, the primary purpose of an entity automatically changes to ensure the survival and self preservation of itself. The new primary purpose is never stated.

the flip side to the tumor analogy would be that Keynesians would try to eat so much that they outgrew the tumor... =)

ReplyDeleteSpending on war machinery gives you a 1:1 return on investment. Once you build it you use it and it's gone. Build a dam or a road or a hospital and you get many times the dollar invested. Or for that matter education which some claim has a 10:1 return. Austrian School Economics sounds like more free market rhetoric to me.

ReplyDeleteThere is no way to increase anyone's appetite when a person lost appetite caused by a high fever more than 106 F-degree.(41C)

ReplyDeleteAny economical activity is done by human beings but never exists without human beings.

Nobody can control economy anytime soon.

People have lost appetite because of unscalable huge amount of derivatives more than 10 times of the global GDP.

No bank can move but just hold cash in case big investors ask for redemption.

Consumers can't move either because of deflationary spiral and can't trust financial institutes because of their lack of ethic.

What the government and Fed has been doing are wrong.

No matter how low they try to change the key rate, it doesn't work since all markets lost their appetite.

Appetite belongs to human beings but not to institutes.

Unless human beings retrieve normal appetite, lowering key rate means nothing, even worse.

The reason why Japan has been struggling such a long time is that the government and BOJ have neglected consumers' appetite.

If their saving interest rate were much higher, consumers sentiment or mind could have been thawing away and their appetite could have come back.

They could have made some certain amount of money to be able to spend from saving money interest.

They are all wrong.

They all need to learn economical psychology.

It's not so difficult but a kind of easy basic economics.