Saturday, August 29, 2009

The Case for Deflation

As Absolute Return Partners wrote in its July newsletter:

The most important investment decision you will have to make this year and possibly for years to come is whether to structure your portfolio for deflation or inflation.

So which is it, inflation or deflation?

I've analyzed this issue in numerous posts, but every day there are new arguments one way or the other from some very smart people.

The biggest deflation bears are rather pessimistic:

- David Rosenberg says that deflationary periods can last years before inflation kicks in

- Renowned economist Dr. Lacy Hunt says that we may have 15-20 years of deflation

The Best Recent Arguments for Deflation

Following are some of the best arguments for deflation.

Wall Street Journal's Scott Patterson writes that we won't get inflation until unemployment is down below 5%:

A rule of thumb is that inflation doesn't become sticky until the unemployment rate dips below 5%...

"I see very little prospect of accelerating inflation" partly because of the employment outlook, said Mark Zandi, chief economist of Moody's Economy.com. "I don't think the risk shifts toward inflation until 2011, or even 2012."

It could take a lot longer for unemployment to go back down to 5%.

Pension expert Leo Kolivakis writes:

The global pension crisis is highly deflationary and yet very few commentators are discussing this!!!

Hoisington's Second Quarter 2009 Outlook states:

One of the more common beliefs about the operation of the U.S. economy is that a massive increase in the Fed’s balance sheet will automatically lead to a quick and substantial rise in inflation. [However] An inflationary surge of this type must work either through the banking system or through non-bank institutions that act like banks which are often called “shadow banks”. The process toward inflation in both cases is a necessary increasing cycle of borrowing and lending. As of today, that private market mechanism has been acting as a brake on the normal functioning of the monetary engine.

For example, total commercial bank loans have declined over the past 1, 3, 6, and 9 month intervals. Also, recent readings on bank credit plus commercial paper have registered record rates of decline. The FDIC has closed a record 52 banks thus far this year, and numerous other banks are on life support. The “shadow banks” are in even worse shape. Over 300 mortgage entities have failed, and Fannie Mae and Freddie Mac are in federal receivership. Foreclosures and delinquencies on mortgages are continuing to rise, indicating that the banks and their non-bank competitors face additional pressures to re-trench, not expand. Thus far in this unusual business cycle, excessive debt and falling asset prices have conspired to render the best efforts of the Fed impotent.

Ellen Brown argues that the break down in the securitized loan markets (especially CDOs) within the shadow banking system dwarfed other types of lending, and argues that the collapse of the securitized loan market means that deflation will - with certainty - continue to trump inflation unless conditions radically change.

Mish writes:

Conventional wisdom regarding money supply suggests there is massive pent up inflation in the works as a result of the buildup of those reserves. The rationale is that 10 times those excess reserves (via fractional reserve lending) will soon be working its way into the economy causing huge price spikes, a collapse in the US dollar, and possibly even hyperinflation.Leverage is increasing again, according to an article in Bloomberg:

However, conventional wisdom regarding the money multiplier is wrong. Australian economist Steve Keen notes that in a debt based society, expansion of credit comes first and reserves come later.

Indeed, this is easy to conceptualize: Banks lent more than they should have, and those loans are going bad at a phenomenal rate. In response, the Fed has engaged in a huge swap-o-rama party with various banks (swapping treasuries for collateral of dubious value) in addition to turning on the printing presses.

This was done so that banks would remain "well capitalized". The reality is those excess reserves are a mirage. Banks need those reserves for credit losses coming down the pike, as unemployment rises, foreclosures mount, and credit card defaults soar.

Banks are not well capitalized, they are insolvent, unwilling and unable to lend...

Total U.S. debt as a percent of GDP surged to 375% in the first quarter, a new post 1870 record, and well above the 360% average for 2008. Therefore, the economy became more leveraged even as the recession progressed.

An over-leveraged economy is one prone to deflation and stagnant growth. This is evident in the path the Japanese took after their stock and real estate bubbles began to implode in 1989.

Banks are increasing lending to buyers of high-yield company loans and mortgage bonds at what may be the fastest pace since the credit-market debacle began in 2007...

“I am surprised by how quickly the market has become receptive to leverage again,” said Bob Franz, the co-head of syndicated loans in New York at Credit Suisse...

Indeed, as I have repeatedly pointed out, Bernanke, Geithner, Summers and the chorus of mainstream economists have all acted as enablers for increasing leverage.

Mish continues:

Creative destruction in conjunction with global wage arbitrage, changing demographics, downsizing boomers fearing retirement, changing social attitudes towards debt in every economic age group, and massive debt leverage is an extremely powerful set of forces.

Bear in mind, that set of forces will not play out over days, weeks, or months. A Schumpeterian Depression will take years, perhaps even decades to play out.

Thus, deflation is an ongoing process, not a point in time event that can be staved off by massive interventions and Orwellian Proclamations "We Saved The World".

Bernanke and the Fed do not understand these concepts, nor does anyone else chanting that pending hyperinflation or massive inflation is coming right around the corner, nor do those who think new stock market is off to new highs. In other words, almost everyone is oblivious to the true state of affairs.

And Naufal Sanaullah writes:

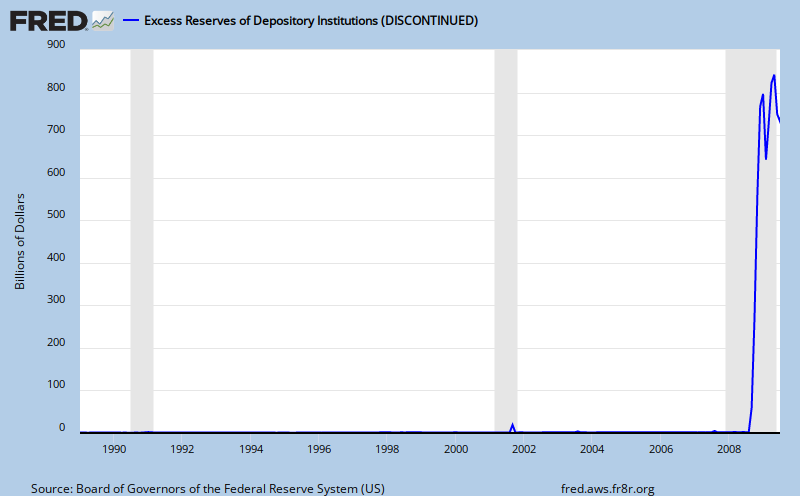

So if all of this printed money is being used by the Fed to purchase toxic assets, where is it going?

Excess reserves, of course. Counting for $833 billion of the Fed's liabilities, the reserve balance with the fed has skyrocketed almost 9000% YoY. Excess reserves, balances not used to satisfy reserve requirements, total $733 billion, up over 38,000%!

The Fed pays interest on these reserves, and with an interest rate (return on capital) comes opportunity cost. Banks hoard the capital in their reserves, collecting a risk-free rate of return, instead of lending it out into the economy. But what happens as more loan losses occur and consumer spending grinds to a halt? The Fed will lower (or get rid of) this interest on reserves.

And that is when the excess liquidity synthesized by the Fed, the printed money, comes rushing in and inflates goods prices.

Of course, most people who are arguing we will have deflation for a while believe that we might eventually get inflation at some point in the future.

6 comments:

→ Thank you for contributing to the conversation by commenting. We try to read all of the comments (but don't always have the time).

→ If you write a long comment, please use paragraph breaks. Otherwise, no one will read it. Many people still won't read it, so shorter is usually better (but it's your choice).

→ The following types of comments will be deleted if we happen to see them:

-- Comments that criticize any class of people as a whole, especially when based on an attribute they don't have control over

-- Comments that explicitly call for violence

→ Because we do not read all of the comments, I am not responsible for any unlawful or distasteful comments.

I have been busy discovering the case -that what we are all experiencing is a collapse of -the vast pragmatic and empirical structure- created by many decades of a haphazardly growing scientific society.

ReplyDeleteThat social edifice has simply toppled over from its own weight and self-destructed.

Part of this structure is the credit economy, which is writhing now like a snake run over by a semi. Forget it.

And Wall Street is but an empty shell -propped-up- by government handouts.

The whole fabric of the medical industry is going in the same direction.

Even our utility industries are imploding -or they are about to come undone, -because consumers are not paying their utility bills.

DEFLATION in the price of everything that was once held high by the credit economy is readily apparent to everyone.

Housing is crushed. For all intents and purposes housing will NEVER recover. That American dream is OVER. Buying real estate today, -even on the cheap- is ONLY an invitation to pay ever-higher property taxes.

What is your house worth when the property taxes go to fifty-thousand dollars a year? NOTHING, FOOL! ABSOLUTELY NOTHING.

The government has had to resort to providing a literal stipend of roughly 10% ($4500) to get people to buy motor vehicles. Those will be the last motor vehicles to leave the car lots for some years to come.

The economy-crushing manipulation of oil to more than twice what it was a week after Obama took office is only a temporary aberration. With as many as are out of work, and apparently not going back to work, the demand for oil is still sloping away from the marketplace -and fast.

There are fools who believe the government is depressing the price of gold. The government is supporting the price of gold with hype.

The price of gold is a bear trap baited for all the Asian and all the Middle Eastern countries foolish enough to put their money into the yellow metal today.

Inflation will eventually set in -in spotty fashion and because -as a neighbor friend of mine iterated last year, "No one's got no fucking money."

BUT! Because the production and distribution assets of this complex and crumbling society are also being destroyed, there will be products that cannot be bought AT ANY PRICE, because they simply are not being produced any more.

Due to the ongoing and irreversible destruction of the economy, THESE PRODUCTS CAN NO LONGER BE PRODUCED.

Cash is king for the foreseeable future.

But don't expect you're going to be able to buy what you want.

A lot of companies are no longer in business, -and those that are-, aren't necessarily producing what they used to -any more.

The overwhelming majority have been burned over the past year. The overwhelming of people are getting burned right now. And the overwhelming majority of people will continue to get burned.

That's the lesson. Be careful.

I seriously hope you don’t believe this deflation scenario for a minute. We got millions of Americans living on fixed income payments from the government. You seriously think these guy’s purchasing powers are going to increase for every day necessities? The money supply is increasing and we have the amount of goods and services contracting (that’s GDP). That’s inflationary and we are seeing it today.

ReplyDeleteInflation doesn’t mean everything goes up in price. Everything is determined by supply and demand. Commodities such as sugar and cocoa are making absolute all time highs, that is inflation for you.

Japan didn’t experience “inflation” in the face of taking on massive amounts of debt. The reason?? Simple, they had a huge capital surplus in foreign investments. Japan was creating new money against their savings that they had overseas and this amounted to easily over $1 trillion dollars. The US has no surplus in the current accounts!!

Please keep spreading this crap about deflation because I need someone to buy into that bullshit so I can sell them my dollars and bonds. Stick to politics since you have no clue about economics.

I’ve lived through I've lived through 15 years of deflation here in Japan. Most Americans haven't had the experience and so can't visualize it. It's terrible and is extremely possible. e.g Rising oil prices won't cause inflation but deflation. It's a cap on economic activity and people just stay home and don't consume. Factories then lay off and the problem spirals down, Fact is; we'll have to have deflation in order to curb unsustainable energy growth. Look for a future that's more hamlet than global village.

ReplyDeleteI think it's even doubtfull that inflation will come roaring back when unemployment drops below 5% because the qualtiy of these jobs coming back will not be good enough to provide for much more than subsistance living. So if we are sticking to the normal definition of too much money chasing too little goods inflation will not return . (maybe never)

ReplyDeleteRegular inflation, i.e., cost push / wage-price spirals, won't happen for a while given the credit overload. So much is true. But hyperinflation is not regular inflation. It's a currency event, which is an entirely different beast! It is characterized by a terminal loss of confidence in the currency. Historically, reckless overspending like we're seeing today in the US/UK and elsewhere has ALWAYS ended in hyperinflation. Bernanke is sending the US down the path of Weimar Germany and Zimbabwe.

ReplyDeleteWell.....It sort of looks like my back yard

ReplyDelete