Thursday, January 6, 2011

Not Just "Inflation Versus Deflation" ... We've Got "MixedFlation" and "ExportFlation"

Many people have made persuasive arguments for inflation.

See, for example, my roundup from 2009, and Gonzolo Lira's recent essay arguing that there is no political will to raise interest rates, and so commodities have become the safe haven investment (replacing bonds).

Many others have made persuasive arguments for deflation.

See, for example, my post from 2009, and Charles Hugh Smith's recent essay arguing that mild deflation is good for the powers-that-be, and so they will make it happen (part II).

But perhaps debates about inflation and deflation paint with too broad a brush, or too narrow a focus ...

Too broad a brush because the economy is not a monolith ... different asset classes can move in different directions at the same time.

Too narrow a focus because you can't analyze what's happening in the U.S. in a vacuum in a highly global economy.

MixedFlation

As I noted in 2008:

I wrote in July 2009:Some people think that some prices will go up at the same time that others go down.

For example, Dominic Frisby writes:Are we going to see rising prices or falling prices? Of course, it depends on the asset class – and in what currency you are measuring.Adam Hamilton of Zeal LLC agrees:***

Falling prices in assets associated with debt - houses and financial stocks – and rising prices in things which you buy with cash – food, energy and some imported goods.So we may very well experience both inflation and deflation.Anything typically financed by debt is likely to see its prices plunge dramatically, like houses and cars, as the ongoing Great Bear bust continues to destroy the gross excesses of debt via higher long rates. Conversely, anything not typically ‘paid for’ with debt, including groceries and general living expenses, is almost certain to rise in the coming years. We are staring down a brutal environment of widespread inflation marked by various sectors witnessing falling prices as debt leverage implodes.

You know from experience that when you're in a national park, movie theater or some other contained place, prices are higher than elsewhere.

Basically, the stores in such places know you can't go somewhere else, so they can charge you what I call "got you" prices. In other words, you're a captive buyer, and they've "got you".

I've noticed the same thing with health care costs. My family's health care premiums increased 6% last year - on top of the 6% increase the year before.

This is "got you" prices. The health care industry knows that Americans are desperate for health care, and that if they raise prices, people will pay.

I've previously pointed out that inflation versus deflation is not necessarily an all-or-nothing proposition: we can have inflation in some asset classes and deflation in others.

So my current theory is that we will have deflation for some time in most asset classes, but inflation in the "got you" classes of basic necessities that everyone needs - food, energy, and health care.

In a tough economy, companies that can squeeze broke consumers for more money will do so

I reported in September 2009:

Well-known financial analyst Dian L. Chu wrote in June 2010:Jeffrey Saut - Chief Investment Strategist and Managing Director of Equity Research at Raymond James - is now confirming that theory:

Saut thinks inflation will eventually win out:Inflation, or deflation, the argument rages; yet on CNBC last Thursday I opined that we are currently experiencing both... It appears to me that the country’s top quintile of wage-earners (the folks with the most assets) are experiencing deflation as their home prices have collapsed, their 401K’s are substantially below where they were in October 2007, their bonuses have been “whacked,” and the list goes on.

Meanwhile, the lower-income households are experiencing inflation with their heath care costs rising, food prices escalating, insurance premiums climbing, etc.Our “bet” is that the inflationary forces will eventually win out because that’s the way it has always played since the Great Depression.But that is not controversial. Indeed, even the greatest advocates of the deflation theory say we may eventually get inflation. For example, David Rosenberg says that deflationary periods can last years before inflation kicks in.

Despite the seemingly tame headline inflation numbers, consumers never seem to see price declines in certain categories like education and health. For instance, prescription drug inflation escalated to 5% from less than 3% in 2007 and 2008.I have seen many reports of rising food, commodity, energy and healthcare costs. But housing is double-dipping, and wages are declining. And see this.

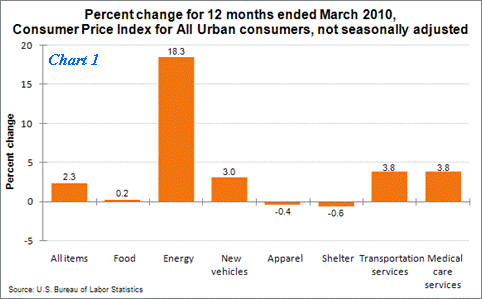

So, it is pretty obvious what we have here--biflation--instead of deflation. Biflation is a state of the economy where inflation and deflation occur simultaneously. (Chart 1)

The price increase of commodities is caused by the increased money flow (via loose monetary policy) chasing them. On the other hand, the growth of economy is tempered with high unemployment and decreasing purchasing power. This has resulted in a greater amount of money directed toward essential items (inflation) and away from non-essential items and things required credit to buy such as house and cars (deflation).

***

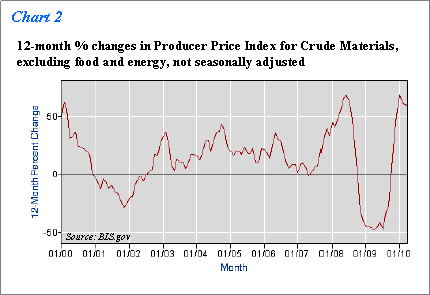

Producer Price Index (PPI) for finished goods was up 5.5% year-over-year. Further up the supply chain, signs of inflation are even more worrisome.

The PPI for intermediate goods increased 8.6% year-over-year in April, while core PPI for crude materials, excluding food and energy, shot up 60% year-over-year in April (Chart 2).

Meanwhile, the Purchasing Manager Index (PMI) report shows manufacturing sector expanded in May for the 10th consecutive month, and the overall economy grew for the 13th consecutive month. Backlogs are also increasing which further points to the inflationary pressure in the pipeline.

***

While all of that money Federal Reserve pumped into the system could in theory cause inflation ... weak banks and slack in the economy would weigh against that. Indeed, it is likely that crude material price increases could begin to move down the supply chain; however, end markets are still too weak to allow a full price increase.

So, in the near term, biflation could be around through possibly 2012 with pockets of inflation seen in certain sectors such as energy and feedstock chemicals, and deflation/low inflation in other sectors, netted to a moderate headline inflation number.

So despite what die-hard inflationists or deflationists might say (and I respect both camps), things are actually mixed.

Moreover, as I pointed out last year:

Given that speculators drove up the price of oil last year, it is possible that - especially in a stagnant economy - speculators could drive up the prices of some asset classes and drive others down.And see this.

ExportFlation

The Fed's easy money policies (including, but not limited to quantitative easing), asset purchases and other policies are sending a lot of hot money flows abroad.

In fact, America has been massively exporting inflation.

As Bloomberg noted last October:

China renewed an attack on quantitative easing, citing the risk of increased prices in emerging economies, a day after the Group of 20 nations said the markets can adopt regulatory steps to cope.

China “doesn’t support” the monetary easing that causes “imported” inflation in developing countries, Commerce Minister Chen Deming told a forum today in Macau, a Chinese special autonomous region. The capital inflows increase the risk of “asset bubbles,” Jin Zhongxia, deputy director general of the international department at the People’s Bank of China, said at the same forum.

***

Major reserve-currency issuing countries excessively print money to get out of their own economic difficulties, posing a policy dilemma for emerging economies,” Jin said in Macau today, without naming any countries. “That will impose greater pressure on capital inflows, bigger bubbles in asset markets and inflationary pressure.” Capital flows into emerging markets are running at $575 billion a year, 20 percent higher than before the world financial crisis, Goldman Sachs Group Inc. said in September.

***

Countries from Brazil and Indonesia to South Korea imposed restrictions on investment inflows aimed at defusing the danger of hot money, or capital seeking short-term gains. The G-20 called on international regulators to compile a report on best practices on financial-security policies, including capital-flow tools.

So not only some asset classes rising and some declining in America, but a portion of the effects from American monetary policies are felt abroad, instead of within the U.S.

The BRIC governments, apparently, are not very happy about America's exported inflation. As Phoenix Capital Research wrote in December:

Over the last few months I’ve noted repeatedly that THE key issue for the financial markets is the ongoing tension building between the Fed’s pro-inflation policy and China’s anti-inflation policy.

***

China’s not the only one. Both Russia and Brazil have recently entered into the “anti-inflation fray” as the below stories attest ....

***

In plain terms, our esteemed Fed Chairman Ben Bernanke is about to find his policies running face first into a BRIC wall. He’s been exporting inflation abroad to the emerging markets all the while claiming it doesn’t exist. With growing civil unrest due to soaring food and energy prices the emerging markets are now fighting back [by raising interest rates].

Andy Xie agrees, arguing that 2011 will be a show-down between China's efforts to curb it's inflation and America's efforts to export it's inflation.

Indeed, a prominent Chinese pro-democracy activist says that inflation will cause the collapse of the current Chinese regime unless it is put in check.

2 comments:

→ Thank you for contributing to the conversation by commenting. We try to read all of the comments (but don't always have the time).

→ If you write a long comment, please use paragraph breaks. Otherwise, no one will read it. Many people still won't read it, so shorter is usually better (but it's your choice).

→ The following types of comments will be deleted if we happen to see them:

-- Comments that criticize any class of people as a whole, especially when based on an attribute they don't have control over

-- Comments that explicitly call for violence

→ Because we do not read all of the comments, I am not responsible for any unlawful or distasteful comments.

I was going to leave a comment, but really, George Bernard Shaw said it best.

ReplyDelete“If history repeats itself, and the unexpected always happens, how incapable must Man be of learning from experience”.

Inflation, massive inflation - for most people, has been the real economic story for decades now. To the upper crusties, the ones who control all this, none of it matters. When prices deflate in a particular area, the 'elite' ones can buy buy buy. When prices inflate, their wealth is 'worth' more. Either way, they win.

ReplyDeleteBiflation is particularly handy right now, from the point of view of the 'elite', in that it pits the middle class against the poor. The middle class worries about deflation (homes and retirement investments losing value), while the poor worry about inflation (necessities of life costing more). The Middle Class wants tax cuts. The Poor want more help. The result is mutual hostility, which obscures the fact that the Middle Class and the Poor are both being victimized by the top one to five percent.