Wednesday, September 30, 2009

Peak Gold?

Gold bug Byron King claims that there is yet another reason that gold might be a reasonable investment: declining production.

In an interview yesterday, King argues:

Because we're in a world that appears to have encountered peak gold as well as peak oil. If you look at historical production, worldwide gold output reached a top right around the year 2000–2001. Overall output has declined and we're not replacing output from the big mines of the past. Despite discoveries here and there, miners have to dig deeper and deeper into the reserves. In a big mining country such as South Africa, for example, some of the deepest mines now are at 4,000 meters. That's 13,000 feet.

Is King right?

Yes, it turns out he might be.

Mining-Technology.com stated in March 2008:

Global gold production has been in steady decline since 2002. Production in 2007 was around 2,444t, down 1% on the previous year.

Analysts note that virtually all of the low-lying fruit has now been picked with respect to gold, meaning that companies will have to take on more challenging and more expensive projects to meet supply. The extent to which the current high price of gold can translate into profits remains to be seen...

According to Bhavesh Morar, national leader of the mining, energy and infrastructure group with Deloitte Australia, frenzied exploration activity over the last few years has seen virtually all of the easy harvest been picked with respect to gold...

The high price of gold is however encouraging more adventurous projects, be they more challenging financially, geologically, geopolitically or all three. New projects for gold and other resources are mushrooming throughout Africa, China, the Middle East and the former Soviet Union; all areas where sovereign risk is potentially very high.

Zeal Speculation and Investment wrote in July of this year:

Miners have the same geological landscape to work with today as those miners thousands of years ago. The only difference is the low-hanging fruit has already been picked. Gold producers must now search for and mine their gold in locations that may not be very amenable to mining. Many of today’s gold mines are located in parts of the world that would not have even been considered in the past based on geography, geology, and/or geopolitics.

And these factors among many are attributable to an alarming trend we are seeing in global mined production volume. According to data provided by the US Geological Survey, global gold production is at a 12-year low. And provocatively this downward trend has accelerated during a period where the price of gold is skyrocketing.

You would think that with the price of gold rising at such a torrid pace gold miners would ramp up production in order to profit from this trend. But as you can see in this chart this has not been the case, at all. Not only has gold production not responded, but it has dropped at an unsightly pace that has sent shockwaves throughout the gold trade.

As the red line illustrates gold’s secular bull began in 2001, finally changing direction after a long and brutal bear market drove down prices to ridiculous lows in the $200s. To match this bull the blue-shaded area provides a picture of the corresponding global production trend. And you’ll notice that in the first 3 years of gold’s bull production was steady. This is not a surprise as you figure it would take the producers a few years to ramp up supply. But instead of supply increasing in response to growing demand and rising prices, it took a turn to the downside. And what’s even more amazing is the persistence of this downtrend. Since 2001 gold production is down a staggering 9.3%! In 2008 there were 7.7m fewer ounces of gold produced than in 2001.

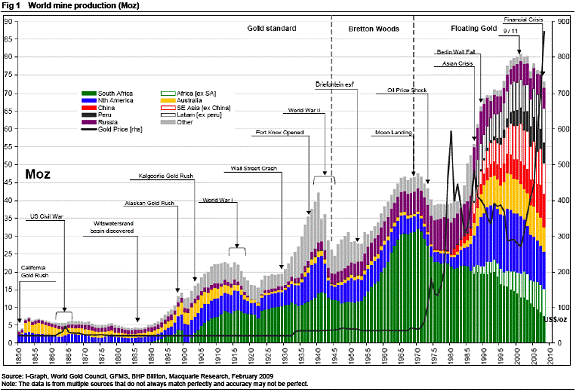

Also in July, Whiskey and Gunpowder posted a chart on historical gold production, and argued for decreasing production:

Take a look at the chart below from Macquarie Research, depicting world gold production 1850-2008...

[Click here for full chart]

For example, look at the very steep rise in gold output during the 1930s. That was during the depths of the worldwide Great Depression.

In both the US/Canada (blue area), and the rest of the world (gray area), people were digging more and more gold. The Soviets (purple area) increased their gold output too, courtesy of Joseph Stalin and his Gulag. Desperate times call for desperate measures, I suppose. Will that sort of history repeat this time around?

Or look at that massive run-up in gold output from South Africa (green area) in the 1950s and 1960s. That was during a time when South Africa was instituting its post-World War II system of apartheid. Labor was cheap (sorrowfully cheap), and quite a lot of international investment poured into South Africa without moral qualm. The South Africans dug deep and just plain tore into those gold-bearing reef structures of the Witwatersrand Basin.

But notice how quickly the South African gold output declined in the 1970s, as the mines got REALLY deep and the rest of the world began to institute sanctions against South Africa over its apartheid system.

And then look at the Gold Price run-up that followed in the late 1970s. It was a time of inflation, mainly coming from the US Dollar. Yet world gold mine output was dropping as well. Falling output, plus monetary inflation? The Gold Price skyrocketed. Another bit of useful history, right?

Now let's focus on more recent history, since about 1990. There were large increases in gold output from the US/Canada (blue), Australia (gold) and Asia (China orange, non-China open bar). By 2000 or so – the world production peak – Gold Prices were down toward $300 per ounce and below.

But as the chart shows, in the past 10 years, gold output has shown a marked DECLINE in the major historic Gold Mining regions. The prolific gold output from the US/Canada, Australia and South Africa has followed downward trends. Sure, these regions still lift a lot of ore and pour a lot of melt. But the production trend is DOWN.

The US/Canada, Australia and South Africa all have well-established and (more or less) workable mining laws – despite the best efforts of many current politicians and regulators to screw it all up. These historically producing areas are politically stable. Overall, there's good mining infrastructure, with road and rail networks, power systems, refining plants, a vendor base, mining personnel and access to capital.

But that's not the case in many areas of the developing parts of the world. Political stability? Security? Infrastructure? Transport? Power? Refining? Vendors? Personnel? Capital? Everywhere is different, of course. But overall, the entire process is much more problematic. So there's a lot more risk. When you move away from the traditional mining jurisdictions, the whole process of exploration, development and mining is more expensive.

Thus, the new gold discoveries of the future are going to lack some (if not most, or perhaps all) of the advantages of the developed mining world. That means that the ore deposits of the future will have to offer much higher profit margins, based on size and ore grade, to compensate for the increased risks. Too bad Mother Nature (or Saint Barbara, who looks after miners) doesn't work that way.

It also means the timeline to develop the mines of the future will likely be stretched over many years while political, legal, bureaucratic, logistical and social issues are ironed out.

The key driver for the future of worldwide gold supply will be DECLINING output overall over time.

Of course, if the price of gold warrant ramping up then production will increase. Just as with discussions about peak oil, the issue is not that the resource is totally running out, it is that it will be more and more expensive to extract.

I know that there have been warnings about peak oil since at least the 1970's. Top experts now say peak oil is real. See this, this and this. But I am not an expert on oil or gold.

Note: I am not an investment advisor and this should not be taken as investment advice.

7 comments:

→ Thank you for contributing to the conversation by commenting. We try to read all of the comments (but don't always have the time).

→ If you write a long comment, please use paragraph breaks. Otherwise, no one will read it. Many people still won't read it, so shorter is usually better (but it's your choice).

→ The following types of comments will be deleted if we happen to see them:

-- Comments that criticize any class of people as a whole, especially when based on an attribute they don't have control over

-- Comments that explicitly call for violence

→ Because we do not read all of the comments, I am not responsible for any unlawful or distasteful comments.

The real headline is "Peak Energy, Peak Resources." The world is entering a long-term bull market in energy and material resources that will remain permanent until overcome through technological innovation, which is not yet on the horizon. While world population is stabiizing and we aren't facing a Malthusian crisis due to over-population as yet and probably won't, the pace of development is increasing demand for limited energy sources and finite resources.

ReplyDeleteOf course, prices are volatile, and there will be some wide swings. But the overall trend is pretty clear, and savvy people like Jim Rogers are advising to buy on pullbacks.

I am also bullish on gold for the simple reason that Asia is becoming much richer and will be the dominating emerging region going forward. Asians are savers and they traditionally love gold as having the most "moneyness." Look to Asia to gobble up gold as its preferred way to store value.

I would be very wary of paying attention to goldbug investment advise, however. These people have one-track minds. In addition, government do attempt to control gold prices, since gold's ultimate moneyness is a brake on the fiat currency regime that prevails in the global economy.

But overall, it seems that gold has a place in a diversified portfolio, with the percentage varying based on monetary stability. Look at the overall trend since 1971.

HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!

ReplyDeletePeak Gold!

HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!HA!

Yes, -by all means! Keep a few gold coins on-hand for the baby-sitter to pilfer, Big Spender.

ReplyDeleteIt's funny how that yellow stuff always seems to go missing.

As for the many and all too predictably complex ways the racketeering con-artists and the syndicate bagmen who've set up shop -and- their card tables out on Wall Street in New-York-City -claim they have for you to invest in their gold investment instrument -without all the bother of having to -dirty- your soft little hands on any of the real heavy stuff, -you're definitely way out on a limb there -and all on your own, Sweetheart.

Read the prospectus -for an eye looking for what's in it for YOU, Mr. Buffett.

No. It's not expensive to maintain, protect, secure or insure a huge pile of gold bullion. There are people out there that will do it for free! Really!

These gold-schemes are all much older than the fable of King Midas, and twice as predictable.

You get to give them your -cash- money for common and inexpensive -promises- about the riches of gold written on a piece of plain paper, transmitted to you by electronic one and zeros, or that you simply get to see -once- stuffed into a brown paperbag -though you are told never to open such a bag.

Dividends? No! Don't be silly, Dr. DeMedici.

Gold don't pay no dividends.

You have to be passive to make money with gold!

Just hand over your money -and sit back and relax. You own a piece of paper that says you own gold. What the hell could be better than that?

If the gold racketeers are making money, they spend it on -advertising- -advertising meant to attract more people to the craze -so they too buy into gold tokens, shares or instruments of gold deceit, and they too drive up the price a little higher.

And when the price of gold crashes?

Don't even think such a thing!

No one ever thinks of -shorting- gold to the rafters, -unless -that is- they know something YOU don't.

Fantastic world mining chart - is it possible to give a larger version as the detail hardly readable. TX for a great blog.

ReplyDeleteCape Town South Africa

The mining and refining of gold has only one purpose: To make the women of this world more beautiful and to keep marriages more stable via wedding rings. The ultimate reason why gold is valuable is very simple: women like it. Since women are more valuable than men (a women produces a few hundred eggs during her life while a men produces literally trillions of sperms - this shows why a women is intrinsically more valuable than men) and men intuitively know that fact, they have to accumulate gold in order to survive genetically. Gold is a symbol of immortality and men can survive only by attracting a women.

ReplyDeleteThis is in my opinion the deeper truth about gold. All the other nonsense published about gold does not even come close to the real truth.

Gold is a symbol for wealth. Wealth is ultimately about survival in time. This does not only include freedom from hunger, protection from the elements, it also includes the ability to transmit our own genes into the future. Gold is related to all of that.

Anonymous.... please use all your capital to SHORT THE CRAP out of gold... and then, sit back up shut up. I'll be passing you in the bread lines... idiot...

ReplyDeleteI find it amazing that no one posting seems aware of the porbability that within, oh say 20 years, that several smart people will have figured how to make microbes or algae or someting similar, poop gold.

ReplyDeleteJust build a large pool, put in the appropriate bug, lots of sun and the appropriate nutrients, dump in sea water, and run a film of the appropriate material on a continuous loop through the solution. when it comes out, peel off the layer of gold, or whatever mineral you want.