Monday, July 18, 2011

Ron Paul: "Every Time the Federal Reserve Engages In More Quantitative Easing and Devalues the Dollar, It Is Defaulting on the American People by Eroding their Purchasing Power and Inflating their Savings Away. The Dollar Has Lost Nearly 50% of Its Value Against Gold Since 2008 ... This Is a Default. Just Because It Is a Default On The People and Not The Banks and Foreign Holders of Our Debt Does Not Mean It Doesn't Count"

Powerful words from Ron Paul:

Politicians need to understand that without real change default is inevitable. In fact, default happens every day through monetary policy tricks. Every time the Federal Reserve engages in more quantitative easing and devalues the dollar, it is defaulting on the American people by eroding their purchasing power and inflating their savings away. The dollar has lost nearly 50% of its value against gold since 2008. The Fed claims inflation is 2% or less over the past few years; however economists who compile alternate data show a 9% inflation rate if calculated more traditionally. Alarmingly, the administration is talking about changing the methodology of the CPI calculation yet again to hide the damage of the government's policies. Changing the CPI will also enable the government to avoid giving seniors a COLA (cost of living adjustment) on their social security checks, and raise taxes via the hidden means of "bracket creep." This is a default. Just because it is a default on the people and not the banks and foreign holders of our debt does not mean it doesn't count.

***

Perhaps the most abhorrent bit of chicanery has been the threat that if a deal is not reached to increase the debt by August 2nd, social security checks may not go out. In reality, the Chief Actuary of Social Security confirmed last week that current Social Security tax receipts are more than enough to cover current outlays. The only reason those checks would not go out would be if the administration decided to spend those designated funds elsewhere. It is very telling that the administration would rather frighten seniors dependent on social security checks than alarm their big banking friends, who have already received $5.3 trillion in bailouts, stimulus and quantitative easing. This instance of trying to blackmail Congress ....

***

We need to stop expensive bombing campaigns against people on the other side of the globe and bring our troops home. We need to stop allowing secretive banking cartels to endlessly enslave us through monetary policy trickery. And we need to drastically rethink government's role in our lives so we can get it out of the way and get back to work.

Remember, quantitative easing doesn't help anyone but the biggest Wall Street companies (and see this, this and this).

And while "the dollar has lost nearly 50% of its value against gold since 2008", it got creamed by Federal Reserve policies before then as well. As I noted last year:

Here's a chart of the trade weighted US Dollar from 1973-2009.

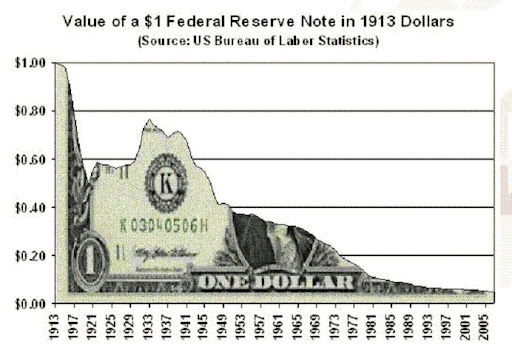

And here's a bonus chart showing the decline in the dollar's purchasing power from 1913 to 2005:

Indeed, Ben Bernanke has previously admitted that inflation is a tax on the American people:

Note: While money printing creates inflation, so does war. Paul's anti-war comments are thus relevant to the economy as well.

4 comments:

→ Thank you for contributing to the conversation by commenting. We try to read all of the comments (but don't always have the time).

→ If you write a long comment, please use paragraph breaks. Otherwise, no one will read it. Many people still won't read it, so shorter is usually better (but it's your choice).

→ The following types of comments will be deleted if we happen to see them:

-- Comments that criticize any class of people as a whole, especially when based on an attribute they don't have control over

-- Comments that explicitly call for violence

→ Because we do not read all of the comments, I am not responsible for any unlawful or distasteful comments.

Hopefully a nationalized banking system will eliminate the vulnerabilities to chicanery and 'back door' investing in endeavors based in British protectorates. The surreptitious acts of slipping 'fine print' theft permits into non-associated legislation have helped create a tapline on the flow of real cash/equity in the U.S. which empties out in banking's British protectorates. The mewlers in congress ignoring the attacks on the U.S. through financial and weather manipulation (Yes, kids. Weather wars IS here.)as well as violent episodes(9-11, the DH oil well blowout)of armed warfare, have earned the right to a place in the unemployment line.

ReplyDeleteThe voters need to know that caring goes both ways and too many people are dieing horrible deaths because Americans don't care.

Pessimism is repulsive. Our benking system and congress are both. They need a total makeover.

I was taught as a child in Jr. High that just printing money will cause inflation, and now we're all paying about 30% more for everything because of inflation since Bernake's last 2 money printing "solutions". This is all being shoved down the throats of the American people and then we're told we love it. The death of America looks like suicide by the treasonous design of elected officials right and left.

ReplyDeletePowerful words from Ron Paul?? I’d call it complete drivel from Ron Paul – what I’d expect from 90% of members of Congress.

ReplyDeleteRe his idea that QE erodes the value of the dollar, inflation has been much the same over the last two years as over the last twenty years! As for the comparison to gold, why not compare to a metal which changes hands in VASTLY bigger quantities (dollar wise), i.e. steel. The price of steel drifted upwards over the last 5 years: at about 2.5% a year. See:

http://www.mongabay.com/images/commodities/charts/chart-steel_rebar.html

Jct: But Ron Paul offers no alternative to the FED. Who's got any gold? The Gold Standard of Money is dead, the UNILETS Time Standard of Money where the IOU for human labor is the currency. http://johnturmel.com/uniset.htm shows you how I set up my own P2P UNILETS Timebank account page at http://facebook.com/john.turmel?sk=info with my Offers, Wants, Hours given, Hours received over the past dozen years. Everyone else soon will timetrade too when they've got no gold and their time is the only asset they have left.

ReplyDelete